Consider a new deposit to the Canadian banking system of ($ 100 0). Suppose that all commercial

Question:

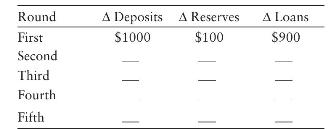

Consider a new deposit to the Canadian banking system of \(\$ 100 0\). Suppose that all commercial banks have a target reserve ratio of 10 percent and there is no cash drain. The following table shows how deposits, reserves, and loans change as the new deposit permits the banks to "create" money.

a. The first round has been completed in the table. Now, recalling that the new loans in the first round become the new deposits in the second round, complete the second round in the table.

b. By using the same approach, complete the entire table.

c. You have now completed the first five rounds of the deposit-creation process. What is the total change in deposits so far as a result of the single new deposit of \(\$ 100 0\) ?

d. This deposit-creation process could go on forever, but it would still have a finite sum. In the text, we showed that the eventual total change in deposits is equal to \(1 / v\) times the new deposit, where \(v\) is the target reserve ratio. What is the eventual total change in deposits in this case?

e. What is the eventual total change in reserves? What is the eventual change in loans?

Step by Step Answer: