From January 1, 2001, to June 2003, the U.S. federal funds rate decreased from 6.5% to 1%.

Question:

From January 1, 2001, to June 2003, the U.S. federal funds rate decreased from 6.5% to 1%. During the same period, the marginal lending facility rate at the European Central Bank decreased from 5.75% to 3%.

a. Considering the change in interest rates over the period and using the loanable funds model, would you have expected funds to flow from the United States to Europe or from Europe to the United States over this period?

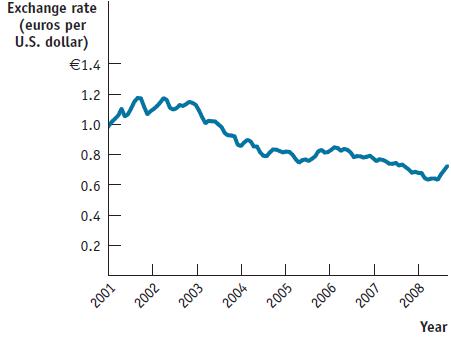

b. The accompanying diagram shows the exchange rate between the euro and the U.S. dollar from January 1, 2001, through September 2008. Is the movement of the exchange rate over the period January 2001 to June 2003 consistent with the movement in funds predicted in part a?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: