In the text we discussed why, in an open economy with international capital mobility, there is a

Question:

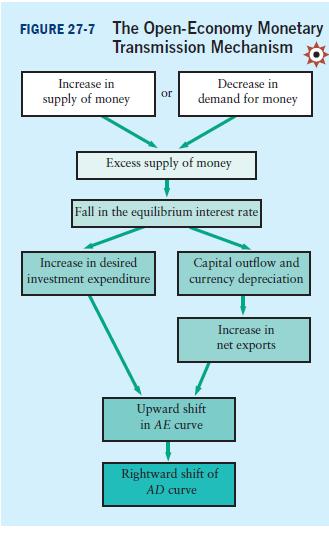

In the text we discussed why, in an open economy with international capital mobility, there is a second part to the monetary transmission mechanism. (It may be useful to review Figure 27 -7 when answering this question.)

a. Explain why an increase in Canada's money supply makes investors shift their portfolios away from Canadian bonds and toward foreign bonds.

b. Explain why this portfolio adjustment leads to a depreciation of the Canadian dollar.

c. Why would such a depreciation of the Canadian dollar lead to an increase in Canada's net exports?

d. Now suppose that the Bank of Canada does not change its policy at all, but the Federal Reserve (the U.S. central bank) increases the U.S. money supply. What is the likely effect on Canada? Explain.

Step by Step Answer: