Monetary policy and the stock market Assume all policy rates, current and expected into the future had

Question:

Monetary policy and the stock market Assume all policy rates, current and expected into the future had been \(2 \%\). Suppose the Fed decides to tighten monetary policy and increase the short-term policy rate \(\left(r_{1 t}ight)\) from \(2 \%\) to \(3 \%\).

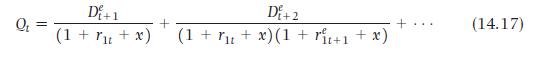

a. What happens to stock prices if the change in \(r_{1 t}\) is expected to be temporary, that is, last for only one period? Assume expected real dividends do not change. Use equation (14.17).

b. What happens to stock prices if the change in \(r_{1 t}\) is expected to be permanent, that is, is expected to persist? Assume expected real dividends do not change. Use equation (14.17).

c. What happens to stock prices today if the change in \(r_{1 t}\) is expected to be permanent and that change increases expected future output and expected future dividends? Use equation (14.17).

Equation 14. 17

Step by Step Answer: