Suppose that Albernias central bank has fixed the value of its currency, the bern, to the U.S.

Question:

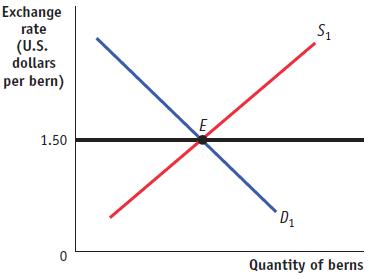

Suppose that Albernia’s central bank has fixed the value of its currency, the bern, to the U.S. dollar (at a rate of US$1.50 to 1 bern) and is committed to that exchange rate. Initially, the foreign exchange market for the bern is also in equilibrium, as shown in the accompanying diagram. However, both Albernians and Americans begin to believe that there are big risks in holding Albernian assets; as a result, they become unwilling to hold Albernian assets unless they receive a higher rate of return on them than they do on U.S. assets. How would this affect the diagram? If the Albernian central bank tries to keep the exchange rate fixed using monetary policy, how will this affect the Albernian economy?

Exchange rate (U.S. dollars per bern) 1.50 0 L D S Quantity of berns

Step by Step Answer:

Students also viewed these Business questions

-

Suppose that Albernias central bank has fixed the value of its currency, the bern, to the Canadian dollar (at a rate of C$1.50 to 1 bern) and is committed to that exchange rate. Initially, the...

-

Utilizing resoorces, complete a risk audit of Bank of Americas project to acquire Merrill Lynch. Ensure you address all 10 critical success factors. From the evidence of your audit, would you advise...

-

Gold has served as a medium of exchange and a store of value. The increase in trade led each country to set a par value for its currency in terms of gold. The gold standard as an international...

-

What is the wavelength of light if its frequency is 1.009 106 Hz?

-

Approximately 13% of the general population is left-handed. A researcher has recently come into contact with a number of left-handed artists and wonders whether artists are more likely to be...

-

The St. Lucia Blood Bank, a private charity partly supported by government grants, is located on the Caribbean island of St. Lucia. The blood bank has just finished its operations for September,...

-

Determine the flowrate for the symmetrical channel shown in Fig. P10.66 if the bottom is smooth concrete and the sides are weedy. The bottom slope is \(S_{0}=0.001\). Fig. P10.66 4 ft 3 ft. 12 ft-

-

The Excel file Credit Risk Data provides a database of information about loan applications along with a classification of credit risk in column L. Convert the categorical data into numerical codes as...

-

The Samsung Global Code of Conduct and Business Conduct Guidelines, which direct every one of their representatives, drive their efforts to deliberately oversee consistency and moral dangers. It also...

-

Suppose the United States and Japan are the only two trading countries in the world. What will happen to the value of the U.S. dollar if the following occur, other things equal? a. Japan relaxes some...

-

In each of the following scenarios, suppose that the two nations are the only trading nations in the world. Given inflation and the change in the nominal exchange rate, which nations goods become...

-

Explain for what kind of frequency distribution an ogive is drawn. Can you think of any use for an ogive? Explain.

-

3. Mr. and Mrs. Smith have just purchased a $600,000 house and have made a down payment of $120,000. They can amortize the balance at 4% for 30 years. a. calculate monthly payments. b. calculate...

-

Interest During Construction Matrix Inc. borrowed $1,100,000 at 8% to finance the construction of a new building for its own use. Construction began on January 1, 2019, and was completed on October...

-

Utilize the stock quote to answer the following questions about Burger King's stock. a. Find the current price per share when this report was generated on Dec 8 th . b. What was the price per share...

-

Compare three alternatives on the basis of their capitalized costs at /= 9% per year and select the best alternative. Alternative First Cost AOC, per Year E $-65,000 $-55.000 $16,000 F $-380,000...

-

(a) Let A = {1,2,3,4}, B = {3kk e Z-{-1,1}} and C = {ne Zn+n = 0}. Which one of the following statements is True? Explain your answer i. AnB = 0 ii. B-C=0 iii. BnC = 0 iv. AUC =0 (b) Let A and B be...

-

Summit Builders has a market debt-equity ratio of 0.65 and a corporate tax rate of 40%, and it pays 7% interest on its debt. By what amount does the interest tax shield from its debt lower Summits...

-

Q:1 Take any product or service offered in Pakistan and apply all determinents of customer Perceived value ?

-

In each of the following examples, explain whether the decision is rational or irrational. Describe the type of behavior exhibited. a. Kookie's best friend likes to give her gift cards that Kookie...

-

You have been hired as a consultant by a company to develop the company's retirement plan, taking into account different types of predictably irrational behavior commonly displayed by employees....

-

Jackie owns and operates a web - design business. To keep up with new technology, she spends $5,000 per year upgrading her computer equipment. She runs the business out of a room in her home. If she...

-

What are the psychological factors underlying resistance to change among stakeholders, and how can change agents employ principles of cognitive-behavioral psychology to mitigate resistance and...

-

Wellness Products, needs a cash budget for September. The following information is available: 1. The cash balance at the beginning of August is 9,000. 2. Contribution margin is 50% (COGS are 50% of...

-

Search online, locate and detail the appropriate toners and maintenance kits that can be used with the two installed printers. What are the toner cartridges rated at for number of pages that can be...

Study smarter with the SolutionInn App