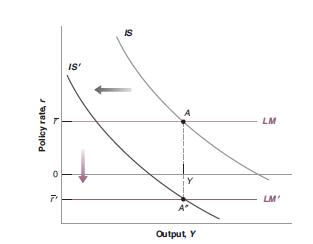

The IS-LM view of the world with more complex financial markets Consider an economy described by Figure

Question:

The IS-LM view of the world with more complex financial markets Consider an economy described by Figure 6-6 in the text.

a. What are the units on the vertical axis of Figure 6-6?

Figure 6-6

b. If the nominal policy interest rate is \(5 \%\) and the expected rate of inflation is \(3 \%\), what is the value for the vertical intercept of the LM curve?

c. Suppose the nominal policy interest rate is \(5 \%\). If expected inflation decreases from \(3 \%\) to \(2 \%\), in order to keep the LM curve from shifting in Figure 6-6, what must the central bank do to the nominal policy rate of interest?

d. If the expected rate of inflation were to decrease from \(3 \%\) to \(2 \%\), does the IS curve shift?

e. If the expected rate of inflation were to decrease from \(3 \%\) to \(2 \%\), does the LM curve shift?

f. If the risk premium on risky bonds increases from \(5 \%\) to \(6 \%\), does the LM curve shift?

g. If the risk premium on risky bonds increases from 5\% to \(6 \%\), does the IS curve shift?

h. What are the fiscal policy options that prevent an increase in the risk premium on risky bonds from decreasing the level of output?

i. What are the monetary policy options that prevent an increase in the risk premium on risky bonds from decreasing the level of output?

Step by Step Answer: