Unwinding unconventional monetary policy It was noted in the text that the Federal Reserve purchased, in addition

Question:

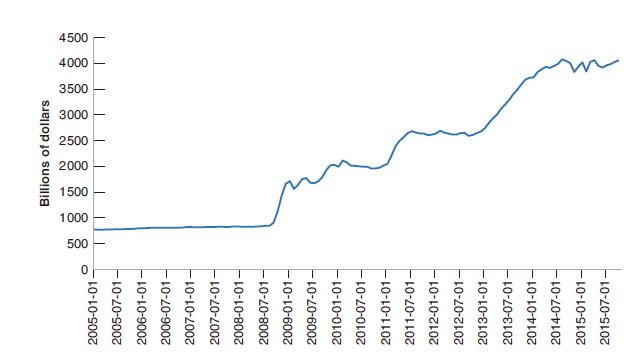

Unwinding unconventional monetary policy It was noted in the text that the Federal Reserve purchased, in addition to Treasury bills, large amounts of mortgage-backed securities and long-term government bonds as part of quantitative easing. Figure 23-2 shows that as of the end of 2015, there were about 4. 5 trillion dollars of assets in the monetary base. These assets were roughly distributed as 0. 2 trillion in Treasury securities with less than one year to maturity; 2. 2 trillion in Treasury securities of more than one year to maturity; and 1. 7 trillion in mortgage-backed securities.

Figure 23-2

a. Why did the Federal Reserve Board buy the mortgage backed securities?

b. Why did the Federal Reserve Board buy the long-term Treasury bonds?

c. What would you predict as the consequences of the following operation by the Federal Reserve Board: selling 0. 5 trillion in mortgage-backed securities and buying 0. 5 trillion in Treasury securities with less than one year to maturity?

d. What would you predict as the consequences of the following operation by the Federal Reserve Board: selling 0.

5 trillion in Treasury securities with maturity longer than one-year and buying 0. 5 trillion in Treasury securities with less than one year to maturity?

Step by Step Answer: