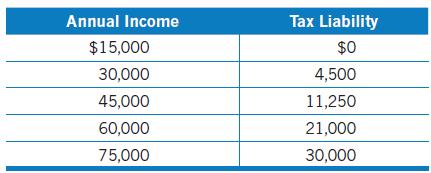

Use the following table to answer the questions. a. What is the average tax rate at each

Question:

Use the following table to answer the questions.

a. What is the average tax rate at each income level?

b. Based on these data, is the tax progressive or regressive? Briefly explain.

c. Is it possible to determine, based on these data, the marginal tax rate of someone earning $65,000 per year? Briefly explain.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: