The United States (unlike other countries) has two types of bank-like financial institutions. Member banks can borrow

Question:

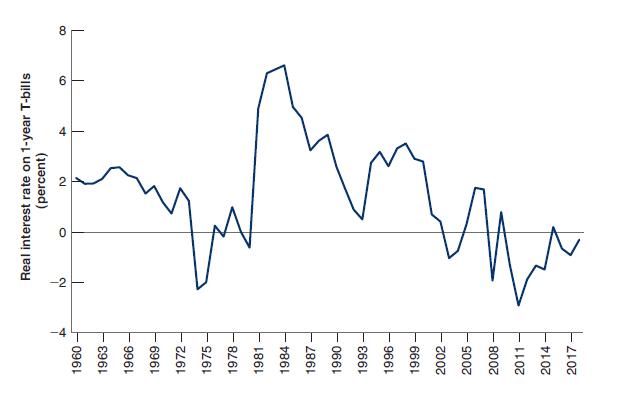

The United States (unlike other countries) has two types of bank-like financial institutions. Member banks can borrow from the Federal Reserve at the discount rate and must keep currency in their vaults or deposits at the Federal Reserve earning the deposit rate as reserves. These rates are shown in Figure 22-3. Nonmember banks can hold their reserves as currency or deposits at member banks. The federal funds rate is the interest rate on oneday loans in financial markets. It is determined by the demand for and the supply of these funds by both member and non-member banks.

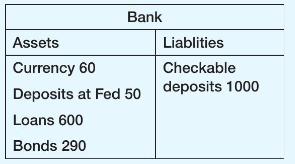

a. If the reserve ratio is \(10 \%\) and a member bank that can place funds on deposit at the Federal Reserve has the balance sheet below, does this bank have excess reserves? If the deposit rate is \(0.5 \%\) and the federal funds rate is \(0.4 \%\), what is the profit-maximizing choice for the overnight placement of excess reserves for the member bank?

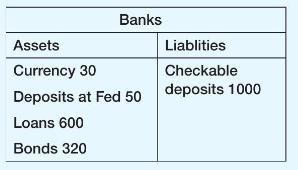

b. If the reserve ratio is \(10 \%\) and a member bank that can place funds on deposit at the Federal Reserve has the balance sheet below, does this bank have excess reserves? If the discount rate is \(0.75 \%\) and the federal funds rate is \(0.8 \%\), how should the profit-maximizing member bank borrow overnight to meet reserve requirements?

c. If all banks in America were member banks, explain why the Federal Reserve could be certain that the federal funds rate fell between the deposit rate and the discount rate?

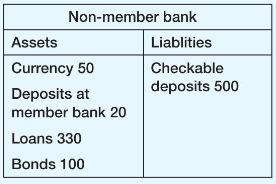

d. In Figure 22-3, the federal funds rate falls slightly below the deposit rate. Explain, using the balance sheet below for a non-member bank, how this would happen. Non-member banks hold part of their required reserves as deposits at member banks.

Data from Figure 22-3

Step by Step Answer: