You are the economic adviser to a newly elected president. In four years he or she will

Question:

You are the economic adviser to a newly elected president. In four years he or she will face another election. Voters want a low unemployment rate and a low inflation rate. However, you believe that voting decisions are influenced heavily by the values of unemployment and inflation in the last year before the election, and that the economy's performance in the first three years of a president's administration has little effect on voting behavior.

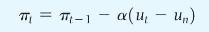

Assume that inflation last year was 10%, and that the unemployment rate was equal to the natural rate. The Phillips curve is assumed to be given by

Assume that you can use fiscal and monetary policy to achieve any unemployment rate you want for each of the next four years. Your task is to help the president achieve low unemployment and low inflation in the last year of his or her administration.

a. Suppose you want to achieve a low unemployment rate (i.e., an unemployment rate below the natural rate) in the year before the next election (four years from today). What will happen to inflation in the fourth year?

b. Given the effect on inflation you identified in part

a, what would you advise the president to do in the early years of the administration to achieve low inflation in the fourth year?

c. Now suppose the Phillips curve is given by \[

\pi_{t}=\pi_{t}^{e}-\alpha\left(u_{t}-u_{n}ight)

\]

In addition, assume that people form inflation expectations, \(\pi_{t}^{e}\), based on consideration of the future (as opposed to looking only at inflation last year) and are aware that the president has an incentive to carry out the policies you identified in parts a and

b. Are the policies you described in those parts likely to be successful? Why or why not?

Step by Step Answer: