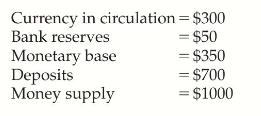

Consider an economy that has the following monetary data: The monetary base and the money supply are

Question:

Consider an economy that has the following monetary data:

The monetary base and the money supply are expected to grow at a constant rate of \(20 \%\) per year. Inflation and expected inflation are \(20 \%\) per year. Suppose that bank reserves and currency pay no interest, all currency is held by the public, and bank deposits pay no interest.

a. What is the cost to the public of the inflation tax?

b. What is the nominal value of seignorage over the year?

c. What is the profit to the banks from the inflation?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Macroeconomics

ISBN: 9780134167398

9th Edition

Authors: Andrew B. Abel, Ben Bernanke, Dean Croushore

Question Posted: