A retail company has a number of individual retail outlets in different towns. Each outlet has its

Question:

A retail company has a number of individual retail outlets in different towns. Each outlet has its own manager who can make decisions about the individual retail outlet, provided these decisions are within the parameters of the overall company policy. The performance of each individual manager is measured based on the profits of the retail outlet that he or she manages.

Company policy

It is company policy that each of the retail outlets should stock the following categories of items for sale to customers:

- newspapers and magazines

- fresh fruit and vegetables

- tinned food items

- frozen food items

Company policy also requires that no single category occupy more than 40% or less than 15% of the total display space available. In addition, at their own discretion, managers are permitted to use up to 10% of the total display space available for other products that meet other localised needs.

The KL retail outlet

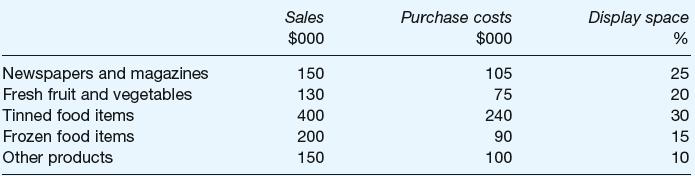

The following weekly sales and cost data relate to the KL retail outlet, one of the outlets owned by the company:

The total display space available is 800 square metres.

For each category of items for sale:

l sales revenue is directly proportional to the floor area occupied;

l purchase costs are directly proportional to sales revenue.

In addition to the purchase costs of the items sold, the retail outlet incurs other costs that total $280,000 per week.

Required:

(a) Demonstrate, using the above information and appropriate calculations, how the manager of the KL retail outlet should allocate the space available between the different categories of items for sale to customers in order to maximise his weekly profit.

(b) You have recently joined the retail company as its Assistant Management Accountant and, as your first project, you have been asked to compare the profitability of a number of the retail outlets. One of those within your comparison is the KL retail outlet.

You have visited the KL retail outlet and have investigated the costs that are being incurred in addition to the purchase costs of the items sold. You have confirmed that typically the retail outlet incurs other costs that total $280,000 per week. Further analysis has shown that these include staff salary costs (excluding any profit-related bonus earned by the manager), staff training costs, rent, light and heat, power, equipment depreciation, point of sale software costs, stationery, telephone, inventory storage and handling costs, marketing costs and head-office charges. You have discussed these other costs with the manager of the retail outlet. The manager of the retail outlet does not think that gross profit should be used as the basis for allocating space to items. He has suggested that some of the other costs be attributed to the product category to which they relate rather than ignored when making the space allocation decision.

Required:

Prepare a report, addressed to the manager of the KL retail outlet that explains

(i) the principles of Direct Product Profitability (DPP);

(ii) how these principles may be applied to his retail outlet;

(iii) how their application may improve the profits of his retail outlet.

Step by Step Answer: