Cleancloths Ltd has two production lines. One line produces Supersnake, an absorbent double strength cloth which soaks

Question:

Cleancloths Ltd has two production lines. One line produces Supersnake, an absorbent double strength cloth which soaks up spillage of industrial liquids. Supersnake cannot be sold for domestic use. The other production line manufacture rolls of absorbent cloth for domestic use.

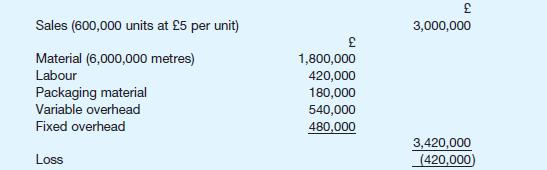

The directors recently considered the following budget for the Supersnake production line for the year ending 31 March Year 5:

The budgeted loss has caused the directors a great deal of concern. They are aware that future demand for Supersnake is uncertain because of new competition in the industrial cleaning market.

The directors have asked you, as the newly appointed management accountant, to investigate two alternative plans:

Plan A: Avoid the budgeted loss by closing the Supersnake production line on 31 March Year 4.

Plan B: Continue production for a further year and close the Supersnake production line on 31 March Year 5.

You have discovered the following information during your investigation:

1 Each unit of Supersnake contains 10 metres of material. It is estimated that at 31 March Year 4 Cleancloths Ltd will have in stock 1,000,000 metres of Supersnake material which would be unsuitable for domestic use. It could be sold for waste at a price of 5 pence per metre.

2 Packaging material for 200,000 units will be in stock at 31 March Year 4. As it is already printed it would have to be scrapped if production ceased on that date. Disposal costs would be negligible.

3 The machine used on the Supersnake production line is five years old. It originally cost £700,000 and is being depreciated on a straight line basis over a ten-year life with no scrap value expected at the end of that time. Depreciation is included in the variable overhead costs in the budget. It is estimated that the machine could be sold for £200,000 on 31 March Year 4. Continued use during the year to 31 March Year 5 would reduce the selling price by £7,000 for every 200,000 units of Supersnake produced.

4 The production manager of the Supersnake line has given notice of his intention to leave on 31 March Year 4. His salary cost of £35,000 per annum is included in the fixed overhead costs. If production were to continue to 31 March Year 5 a temporary supervisor would have to be hired at an estimated cost of £31,000 per annum.

5 Other fixed overhead costs comprise items which could not be avoided by closure of the Supersnake line.

6 Production and sales volumes will be equal throughout the year.

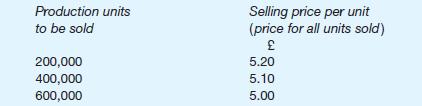

7 If production is to take place during the year to 31 March Year 5 it must be at one of three levels of output. The marketing manager has estimated the unit selling price which may be obtained for each of these alternative levels of output:

8 Labour costs vary in proportion to output. Employees no longer required for production of Supersnake could be redeployed within the company at no extra cost.

Required

Prepare a report to the directors of Cleancloths Ltd on the relative costs and benefits of Plan A compared with Plan B.

Step by Step Answer: