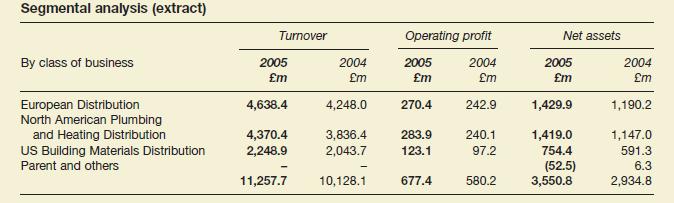

The following information is extracted from the annual report of Wolseley plc. Finance objectives (extract) To deliver

Question:

The following information is extracted from the annual report of Wolseley plc.

Finance objectives (extract)

To deliver an incremental return on gross capital employed at least 4%

in excess of the pre-tax weighted average cost of capital. In 2005 the Group’s return on capital was 19.1%, 7.2% ahead of our estimated pre-tax weighted average cost of capital of 11.9%.

Discussion points

1 What is the relative performance of the three divisions, in profitability and return on capital employed?

2 Using the company’s stated cost of capital, what is the relative performance based on residual income?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: