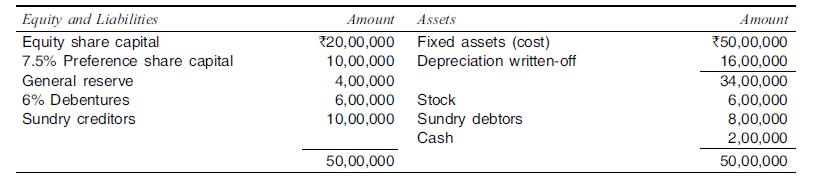

Below is given the balance sheet of Best Ltd, as on March 31, of the current year:

Question:

Below is given the balance sheet of Best Ltd, as on March 31, of the current year:

The following additional information is available:

(1) Fixed assets costing ₹10,00,000 to be installed on April 1, and would become operative on that date, payment to be made on March 31 of next year.

(2) The fixed assets turnover ratio (on the cost of the fixed assets) would be 1.5.

(3) The stock turnover ratio would be 14.4 (calculated on the basis of the average of the opening and closing stocks).

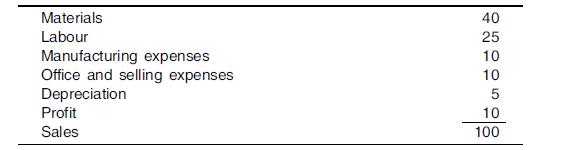

(4) The break-up of cost and profit would be as follows (percentages):

The profit is subject to debenture interest and taxation @ 35 per cent.

(5) Debtors would be 1/9 of turnover.

(6) Creditors would be 1/5 of materials consumed.

(7) In March next year a dividend of 10 per cent on equity capital would be paid.

(8) ₹5,00,000, 6% debentures would be issued on April 1, next year.

You are required to prepare the forecast balance sheet as on March 31, next year and calculate the resultant:

(a) Current ratio;

(b) Fixed Assets/Net worth ratio; and

(c) Debt-equity ratio (The turnover above refers to the value of sales).

Step by Step Answer:

Management Accounting Text Problems And Cases

ISBN: 9781259026683

6th Edition

Authors: M Y Khan, P K Jain