Bisky Bites Corporation is a biscuit-making company and manufactures chocolate-flavoured biscuits. A senior accountant is responsible for

Question:

Bisky Bites Corporation is a biscuit-making company and manufactures chocolate-flavoured biscuits. A senior accountant is responsible for formulating the master budget of the company. The company uses the master budget to evaluate managers' performance. The top management of the company observed that the budget underestimates earnings and overestimates costs. The top management has recruited you as the company's chief accounting officer. You have been given the responsibility to formulate the master budget for the third and fourth quarters of the current year. Based on the discussions with the accountants and managers of various teams, you have gathered the information given below.

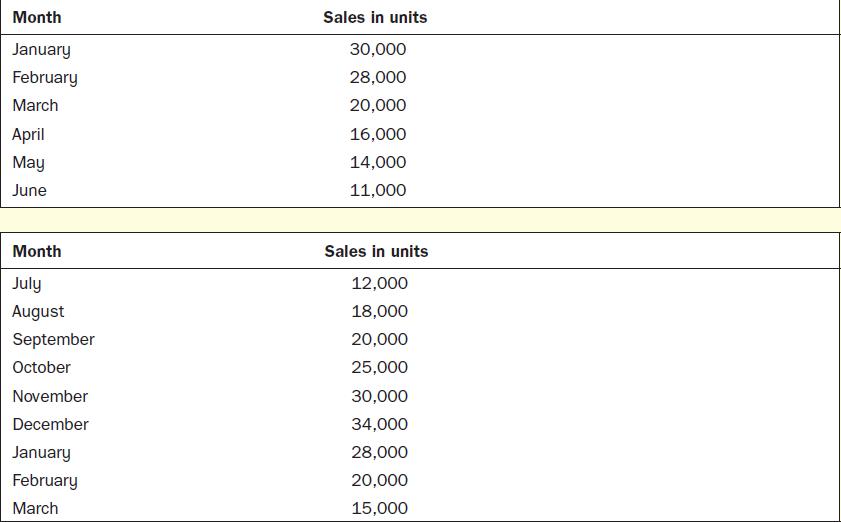

Bisky Bites sells biscuits in cardboard boxes. Each box contains 20 packets of biscuits. The actual sales (in number of cardboard boxes) for January to June are given below:

The budgeted sales (in number of cardboard boxes) for July to December of the current year and for January to March of the next year are given below:

Sales are at their peak in December because of Christmas and New Year. The price per cardboard box of biscuits is £20. Of the sales, 80% is on credit and there are no discounts. Of the credit sales, 60% is collected in the month following the sales. The remaining 40% of the credit sales is collected in the second month following the sales. Bad debts are insignificant and can be ignored. At the end of each month, a finished goods inventory equal to 20% of the next month's sales should be maintained.

The company requires 3 kg of wheat flour to manufacture one cardboard box of biscuits. One kilogram of wheat flour costs £2.00. All raw materials are purchased on credit. There are no discounts provided. Twenty five per cent of the payment towards credit purchases is made in the month of purchase and the remaining 75% of the payment is made in the following month. At the end of each month, the company should maintain a raw materials inventory equal to 10% of the next month's production needs.

To manufacture one cardboard box of biscuits, 0.25 direct labour hours are required. Bisky Bites direct labour workforce is not adjusted each month. The company's policies do not allow it to lay off and rehire workers as needed. The company's direct labour workforce consists of 40 permanent employees. Each of them is guaranteed at least 100 hours of pay each month. The workers are paid £7.50 per hour. In case a worker works more than 150 hours in a month, the labour rate is £9.50 per hour for the overtime hours.

The manufacturing costs are divided into variable cost and fixed cost. The variable cost is £3.00 per cardboard box of biscuits manufactured. The fixed manufacturing overhead excluding depreciation is £18,000 per month.

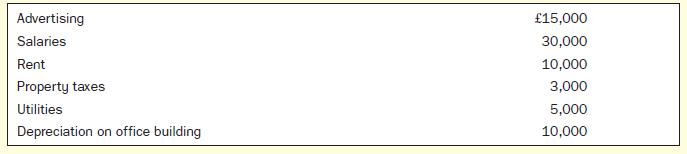

The variable selling and administration expense is £2.50 per cardboard box of biscuits sold. Other fixed selling and administrative expenses per month are given below. The expenses are paid in the same month.

Bisky Bites declares dividends of £8,000 each quarter. These are payable at the end of the same quarter.

Bisky Bites has a corporate policy of maintaining a cash balance of £40,000 at the end of each month. If there is a cash deficiency during any month, the company borrows the money, as needed, from a bank. If there is excess cash during any month, the company will either repay the funds borrowed in the previous months or invest the funds. The annual interest rate on the borrowing is 10%. The company follows the calendar year reporting period.

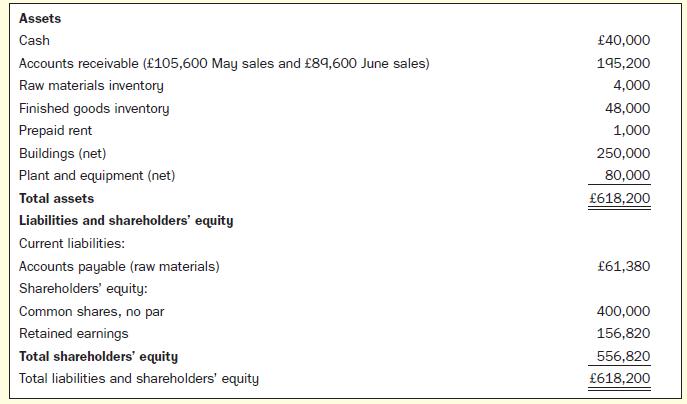

The company's ledger balances as of 30 June are given below:

Required

1. Calculate the total budgeted cash collections of Bisky Bites in September.

2. Calculate the budgeted number of units (number of cardboard boxes of biscuits) that are required to be manufactured in August.

3. Which of the following combinations of month and the budgeted cost of raw materials are correct?

(a) July: £129,000

(b) August: £111,960

(c) September: £186,000

(d) October: £158,880

4. Calculate the budgeted cash payment towards the purchase of raw materials in November.

5. Calculate the total direct labour cost of Bisky Bites in August.

6. Calculate the budgeted cash disbursement for manufacturing overhead for September.

7. Identify the fixed selling and administrative expense of Bisky Bites that is subtracted from the total selling and administrative expenses to determine the cash disbursements of selling and administrative items.

8. According to the cash budget of Bisky Bites, which of the following statements are correct?

(a) Bisky Bites will have a cash deficit of £830 in July.

(b) Bisky Bites will have to borrow £34,030 in August.

(c) Bisky Bites will have excess cash over disbursements of £24,505 in September.

(d) Bisky Bites will have to borrow £22,730 in October.

Step by Step Answer:

Management Accounting

ISBN: 9780077185534

6th Edition

Authors: Will Seal, Carsten Rohde, Ray Garrison, Eric Noreen