Blue Ltd, which manufactures garments, has recently formed a new department, Department J, which manufactures denim jackets.

Question:

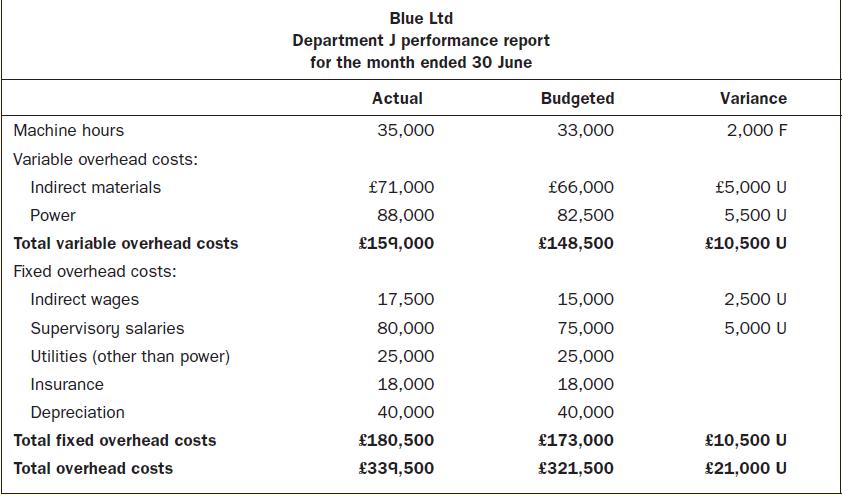

Blue Ltd, which manufactures garments, has recently formed a new department, Department J, which manufactures denim jackets. The top management of the company is unsure of the accuracy of the performance report prepared by the accountant. Hence, the company has hired you as a senior accountant. Given below is the performance report prepared by the accountant. The company wants you to examine the report.

You analysed the report and found it unrealistic. Based on your discussion with the supervisor and the manager of Department J, you have gathered the information given below.

• The standard time to be taken to produce one denim jacket is 2 machine hours.

• The denominator machine hours was estimated to be 33,000 hours.

• In the second week of June, Department J produced 17,000 denim jackets, instead of the planned 16,500 denim jackets, to meet the increased demand needs.

• To meet the increased demand, the direct labour workforce and the supervisors of Department J had worked for additional hours and the company has paid them more incentives.

• During the month, the company had also hired an additional security guard for Department J.

1. Determine whether the accountant of Blue Ltd used the flexible budget approach to prepare the performance report of Department J.

2. Based on your suggestion, Department J of Blue Ltd prepares a flexible budget for the month of June. Explain what the report should show the company.

3. Calculate the variable overhead spending variance of Department J.

4. Identify the possible reasons for an unfavourable overhead spending variance.

5. Calculate the variable overhead efficiency variance for Department J.

6. Calculate the predetermined overhead rates for variable overhead costs, fixed overhead costs and total overhead costs.

7. Calculate the fixed overhead volume variance for Department J.

8. Calculate the overhead costs of Department J in the month of June.

Step by Step Answer:

Management Accounting

ISBN: 9780077185534

6th Edition

Authors: Will Seal, Carsten Rohde, Ray Garrison, Eric Noreen