CrossMan Corporation, a rapidly expanding crossbow distributor to retail outlets, is in the process of formulating plans

Question:

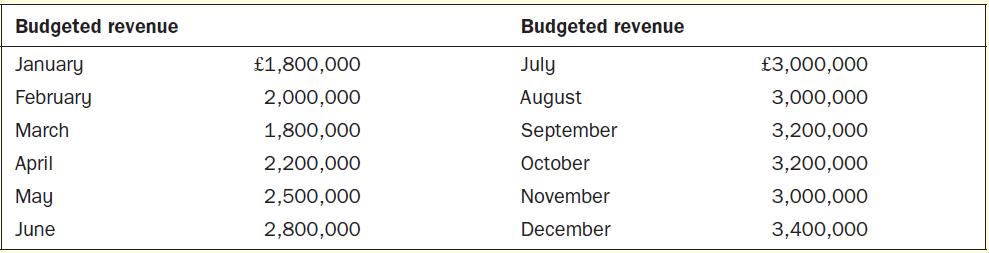

CrossMan Corporation, a rapidly expanding crossbow distributor to retail outlets, is in the process of formulating plans for next year. Joan Caldwell, director of marketing, has completed her sales budget and is confident that sales estimates will be met or exceeded. The following budgeted revenue figures show the growth expected and will provide the planning basis for other corporate departments.

George Brownell, assistant chief accountant, has been given the responsibility for formulating the cash budget, a critical element during a period of rapid expansion. The following information provided by operating managers will be used in preparing the cash budget.

1. CrossMan has experienced an excellent record in debt collection and expects this trend to continue. Sixty per cent of billings are collected in the month after the sale and 40% in the second month after the sale. Uncollectable accounts are negligible and will not be considered in this analysis.

2. The purchase of the crossbows is CrossMan’s largest expenditure; the cost of these items equals 50% of revenue. Sixty per cent of the crossbows are received one month prior to sale and 40% are received during the month of sale.

3. Prior experience shows that 80% of creditors are paid by CrossMan one month after receipt of the purchased crossbows, and the remaining 20% are paid the second month after receipt.

4. Hourly wages, including fringe benefits, depend on sales volume and are equal to 20% of the current month’s revenue. These wages are paid in the month incurred.

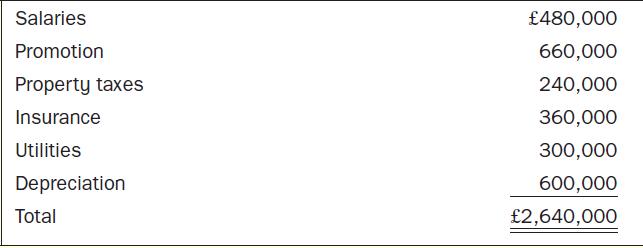

5. General and administrative expenses are budgeted to be £2,640,000 for the year. The composition of these expenses is given below. All of these expenses are incurred evenly throughout the year except the property taxes. Property taxes are paid in four equal instalments in the last month of each quarter.

6. Corporation tax payments are made by CrossMan in the first month of each quarter based on the profit for the prior quarter. CrossMan’s tax rate is 40%. CrossMan’s net profit for the first quarter is projected to be £612,000.

7. Equipment and warehouse facilities are being acquired to support the company’s rapidly growing revenue. Purchases of equipment and facilities are budgeted at £28,000 for April and £324,000 for May.

8. CrossMan has a corporate policy of maintaining an end-of-month cash balance of £100,000. Cash is borrowed or invested monthly, as needed, to maintain this balance. Interest expense on borrowed funds is budgeted at £8,000 for the second quarter, all of which will be paid during June.

9. CrossMan uses a calendar year reporting period.

Required

1. Prepare a cash budget for CrossMan Corporation by month and in total for the second quarter. Be sure that all receipts, disbursements and borrowing investing amounts are shown for each month. Ignore any interest income associated with amounts invested.

2. Discuss why cash budgeting is particularly important for a rapidly expanding company such as CrossMan Corporation.

Step by Step Answer:

Management Accounting

ISBN: 9780077185534

6th Edition

Authors: Will Seal, Carsten Rohde, Ray Garrison, Eric Noreen