Gant Products Ltd has recently introduced budgeting as an integral part of its corporate planning process. The

Question:

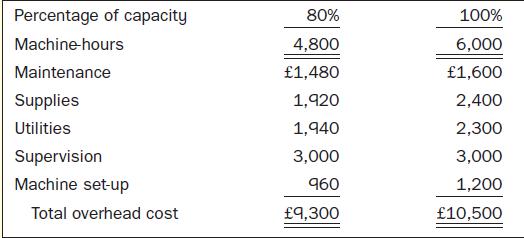

Gant Products Ltd has recently introduced budgeting as an integral part of its corporate planning process. The company’s first effort at constructing a flexible budget for manufacturing overhead is shown below:

The budgets above are for costs over a relevant range of 80 to 100% of capacity on a monthly basis. The managers who will be working under these budgets have control over both fixed and variable costs.

Required

1. Redo the company’s flexible budget, presenting it in better format. Show the budget at 80, 90 and 100% levels of capacity. (Use the high–low method to separate fixed and variable costs.)

2. Express the budget prepared in Requirement 1 above in cost formula form using a single cost formula to express all overhead costs.

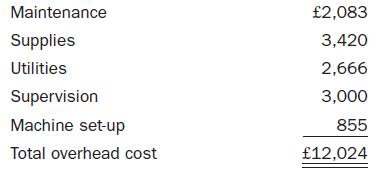

3. The company operated at 95% of capacity during April in terms of actual hours of machine time recorded in the factory. A total of 5,600 standard machine-hours were allowed for the output of the month. Actual overhead costs incurred were:

The fixed costs had no variances. Prepare an overhead performance report for April. Structure your report so that it shows only a spending variance for overhead. You may assume that the master budget for April called for an activity level during the month of 6,000 machine-hours.

4. Upon receiving the performance report you have prepared, the production manager commented, ‘I have two observations to make. First, I think there’s an error in your report. You show an unfavourable spending variance for supplies, yet I know that we paid exactly the budgeted price for all the supplies we used last month. Pat Stevens, the purchasing agent, made a comment to me that our supplies prices haven’t changed in over a year. Second, I wish you would modify your report to include an efficiency variance for overhead. The reason is that waste has been a problem in the factory for years and the efficiency variance would help us get overhead waste under control.’

(a) Explain the probable cause of the unfavourable spending variance for supplies.

(b) Compute an efficiency variance for total variable overhead and explain to the production manager why it would or would not contain elements of overhead waste.

Step by Step Answer:

Management Accounting

ISBN: 9780077185534

6th Edition

Authors: Will Seal, Carsten Rohde, Ray Garrison, Eric Noreen