Goldwyn Electronics had a fixed factory overhead budget for 2010 of $10 million. The company planned to

Question:

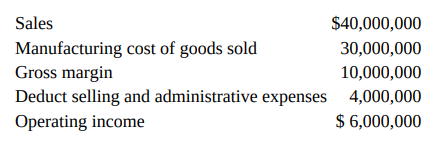

Goldwyn Electronics had a fixed factory overhead budget for 2010 of $10 million. The company planned to make and sell 2 million units of a particular communications device. All variable manufacturing costs per unit were $10. The budgeted income statement contained the following:

For simplicity, assume that the actual variable costs per unit and the total fixed costs were exactly as budgeted.

1. Compute Goldwyn’s budgeted fixed factory overhead per unit.

2. Near the end of 2010, a large computer manufacturer offered to buy 100,000 units for $1.3 million on a one-time special order. The president of Goldwyn stated, “The offer is a bad deal. It’s foolish to sell below full manufacturing costs per unit. I realize that this order will have only a modest effect on selling and administrative costs. They will increase by a $20,000 fee paid to our sales agent. Compute the effect on operating income if the offer is accepted.

3. What factors should the president of Goldwyn consider before finally deciding whether to accept the offer?

4. Suppose the original budget for fixed manufacturing costs was $10 million, but budgeted units of product were 1 million. How would your answers to numbers 1 and 2 change? Be specific.

Step by Step Answer:

Management Accounting

ISBN: 978-0132570848

6th Canadian edition

Authors: Charles T. Horngren, Gary L. Sundem, William O. Stratton, Phillip Beaulieu