Mercer Asbestos Removal Company is in the business of removing potentially toxic asbestos insulation and related products

Question:

Mercer Asbestos Removal Company is in the business of removing potentially toxic asbestos insulation and related products from buildings. There has been a long-simmering dispute between the company's estimator and the work supervisors. The on-site supervisors claim that the estimators do not take enough care in distinguishing between routine work such as removal of asbestos insulation around heating pipes in older homes and non-routine work such as removing asbestos-contaminated ceiling plaster in industrial buildings.

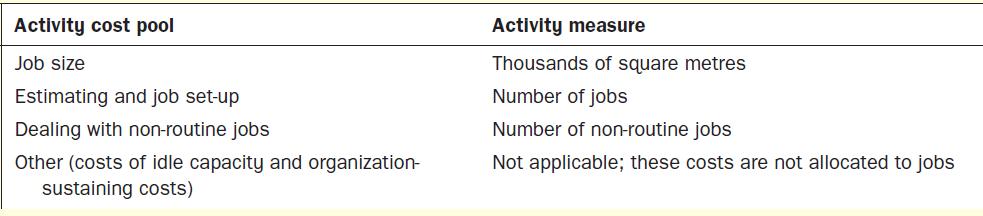

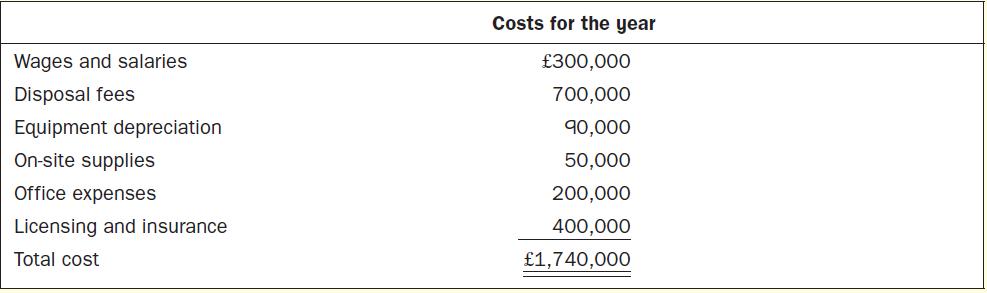

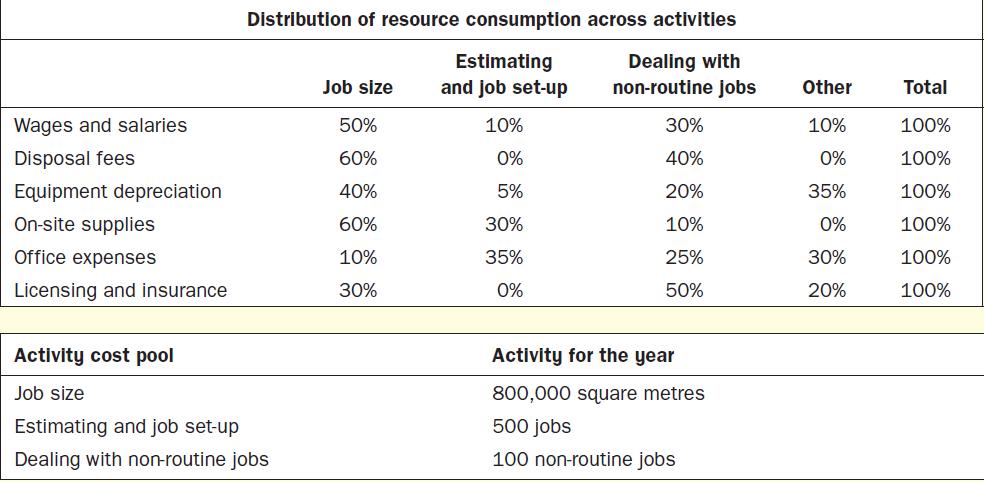

The on-site supervisors believe that non-routine work is far more expensive than routine work and should bear higher customer charges. The estimator sums up his position in this way: 'My job is to measure the area to be cleared of asbestos. As directed by top management, I simply multiply the square metreage by L2.50 to determine the bid price. Since our average cost is only L2.175 per square metre, that leaves enough cushion to take care of the additional costs of non-routine work that shows up. Besides, it is difficult to know what is routine or not routine until you actually start tearing things apart.' Partly to shed light on this controversy, the company initiated an activity-based costing study of all of its costs. Data from the activity-based costing system follow:

Required

1. Perform the first-stage allocation of costs to the activity cost pools.

2. Compute the activity rates for the activity cost pools.

3. Using the activity rates you have computed, determine the total cost and the average cost per thousand square metres of each of the following jobs according to the activity-based costing system. (You will not be able to do an activity analysis because the ease of adjustment codes have not been provided.)

(a) A routine 1,000-square-metre asbestos removal job.

(b) A routine 2,000-square-metre asbestos removal job.

(c) A non-routine 2,000-square-metre asbestos removal job.

4. Given the results you obtained in requirement 3 above, do you agree with the estimator that the company’s present policy for bidding on jobs is adequate?

Step by Step Answer:

Management Accounting

ISBN: 9780077185534

6th Edition

Authors: Will Seal, Carsten Rohde, Ray Garrison, Eric Noreen