Murl Plastics Ltd purchased a new machine one year ago at a cost of 60,000. Although the

Question:

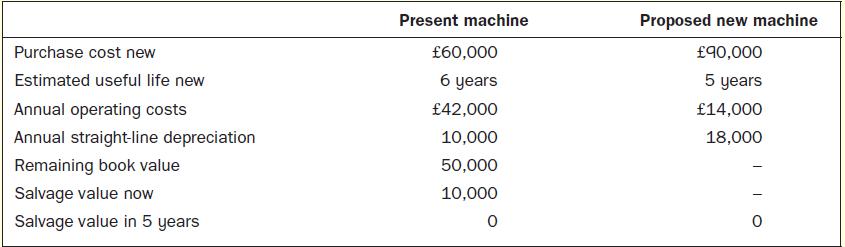

Murl Plastics Ltd purchased a new machine one year ago at a cost of £60,000. Although the machine operates well, the managing director (MD) wondered if the company should replace it with a new electronically operated machine that has just come on the market. The new machine would slash annual operating costs by two-thirds, as shown in the comparative data below:

In trying to decide whether to purchase the new machine, the MD has prepared the following analysis:

‘Even though the new machine looks good,’ said the managing director, ‘we can’t get rid of the old one if it means taking a huge loss on it. We’ll have to use it for at least a few more years.’ Revenue are expected to be £200,000 per year, and selling and administrative expenses are expected to be £126,000 per year, regardless of which machine is used.

Required

1. Prepare a summary profit statement covering the next five years, assuming:

(a) That the new machine is not purchased.

(b) That the new machine is purchased.

2. Determine the desirability of purchasing the new machine using only relevant costs in your analysis.

Step by Step Answer:

Management Accounting

ISBN: 9780077185534

6th Edition

Authors: Will Seal, Carsten Rohde, Ray Garrison, Eric Noreen