Notren Solutions is a retail company. In recent years, the company has received orders from its neighbouring

Question:

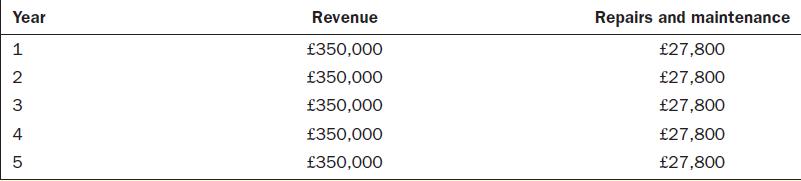

Notren Solutions is a retail company. In recent years, the company has received orders from its neighbouring cities. The company’s transport fleet does not currently have the capacity to handle the high demand. Hence, Notren Solutions is planning to invest in a fleet of heavy goods vehicles to meet its customer demand from neighbouring cities. The company has an option to invest in either Vehicle A or Vehicle B. The initial capital investment budgeted for investment in a fleet of Vehicle A is £1,357,250. The vehicles will have a useful life of five years. The scrap value at the end of five years is negligible. The following additional information relates to the investment in Vehicle A:

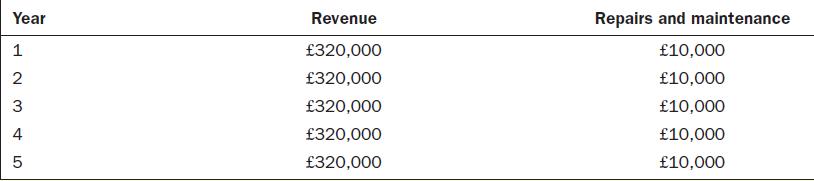

The initial capital investment budgeted for investment in a fleet of Vehicle B is £1,100,000. The vehicles will have a useful life of five years. The scrap value at the end of five years is negligible. The following additional information relates to the investment in Vehicle B:

The company has set a hurdle rate of 10% for the investment. Currently, the company uses the accounting rate of return method to assess the viability of its investments. You have been appointed as the new financial executive of the company, and you have suggested that the company should use a capital budgeting technique that considers discounted cash flows.

Required

1. Notren Solutions currently uses the accounting rate of return method of capital budgeting. As the financial executive of the company, explain the disadvantages of the accounting rate of return method.

2. Based on your suggestion, Notren Solutions has decided to use the internal rate of return method of capital budgeting. Calculate the internal rate of return that is promised by an investment in the fleet of Vehicle A. Also, determine if the investment in Vehicle A is acceptable or not.

3. Calculate the internal rate of return arising from the investment in the fleet of Vehicle B. Determine if the investment in Vehicle B is acceptable or not. Refer to Exhibit 14C.4 for present value of an annuity table.

4. As a financial executive of the company, you have suggested the company use the net present value method to determine the viability of its investment. Explain what a positive net present value, a negative net present value and a zero net present value indicate.

Step by Step Answer:

Management Accounting

ISBN: 9780077185534

6th Edition

Authors: Will Seal, Carsten Rohde, Ray Garrison, Eric Noreen