Ogopogo Enterprises runs a chain of drive-in ice cream stands in the Okanagan Valley during the summer

Question:

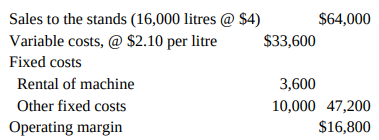

Ogopogo Enterprises runs a chain of drive-in ice cream stands in the Okanagan Valley during the summer season. Managers of all stands are told to act as if they owned the stand and are judged on their profit performance. Ogopogo Enterprises has rented an ice cream machine for the summer to supply its stands with ice cream. Rent for the machine is $3,600. Ogopogo is not allowed to sell ice cream to other dealers because it cannot obtain a dairy licence. The manager of the ice cream machine charges the stands $4 per litre. Operating figures for the machine for the summer are as follows,

The manager of the Winfield Drive-In, one of the Ogopogo drive-ins, is seeking permission to sign a contract to buy ice cream from an outside supplier at $3.35 a litre. The Winfield Drive-In uses 3,000 litres of ice cream during the summer. Rose Clarkson, controller of Ogopogo, refers this request to you. You determine that the other fixed costs of operating the machine will decrease by $900 if the Winfield Drive-In purchases from an outside supplier. Clarkson wants an analysis of the request in terms of overall company objectives and an explanation of your conclusion. What is the appropriate transfer price?

Step by Step Answer:

Management Accounting

ISBN: 978-0132570848

6th Canadian edition

Authors: Charles T. Horngren, Gary L. Sundem, William O. Stratton, Phillip Beaulieu