Remix Ltd is a medium-sized manufacturing company selling two distinct products, the ARMIX and the ORMIX. The

Question:

Remix Ltd is a medium-sized manufacturing company selling two distinct products, the ARMIX and the ORMIX. The products use similar materials but the processes to make them are different. The company has the following information regarding cost:

• ARMIX uses £5 of direct materials, and ORMIX uses £6 of direct materials

• ARMIX uses 2 hours of direct labour, and ORMIX uses 3 hours of direct labour

• The hourly labour rate at Remix is £5 per hour

• The budget for indirect production overhead costs is £100,000 The company’s forecast for annual sales are 4,000 units for ARMIX and 3,000 units for ORMIX

Required

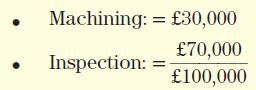

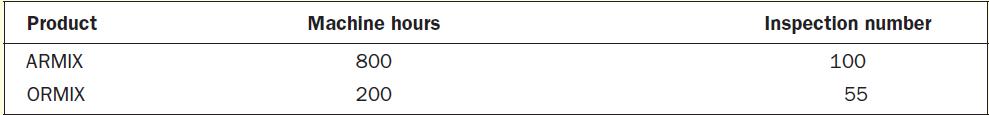

1. Calculate the total product cost for both products using absorption costing. Apportion the indirect cost based on direct labour hours. The company is facing a lot of competition from new business entries and they know that the price of ORMIX is a problem. They may need to discontinue the product if they are unable to reduce its price. To re-evaluate its pricing strategy, the company will recalculate prices using activity-based costing. Last year they had several meetings with managers and employees and they have decided that two activities should be considered: machining (operating with machines) and inspections. The cost pool for each of the activities is allocated as follows:

Other decisions taken in the meetings are:

• The cost driving for machining will be machine hours

• The cost driver for inspections will be the number of inspections

2. Calculate the total product cost for ARMIX and ORMIX using the activity-based costing method.

3. Based on the result from ABC, would you recommend the business to discontinue ORMIX? Explain your answer.

4. Based purely on costing evidence from ABC, if the company is deciding to invest in advertising, which product should the business focus on selling?

5. Explain why the cost per unit is different in each costing method.

6. After looking at the results, the managers have decided to continue producing ORMIX and changes in the prices will be undertaken only for ORMIX. Do you agree with this decision? Explain your answer.

Step by Step Answer:

Management Accounting

ISBN: 9780077185534

6th Edition

Authors: Will Seal, Carsten Rohde, Ray Garrison, Eric Noreen