The Venus Department Store operates a customer loan facility. If one of its new customers requests a

Question:

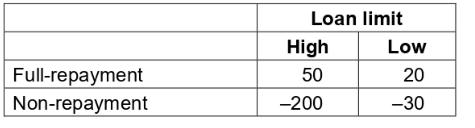

The Venus Department Store operates a customer loan facility. If one of its new customers requests a loan then Venus either refuses it, gives a high loan limit, or gives a low loan limit. From a number of years past experience the probability that a new customer makes a full repayment of a loan is known to be 0.95 , whilst the probability of non-repayment is 0.05 (these probabilities being independent of the size of loan limit). The average profit in $\$$, per customer made by Venus is given by the following table.

Required:

(a) In the past the company has used a selection criterion that is totally arbitrary (i.e. it is not influenced by the customer's ability to repay).

Prepare a decision tree to represent the information. Calculate the expected value and explain what the management of Venus should do if a new customer requests a loan?

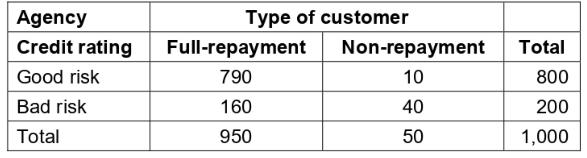

(b) Venus can apply to an agency to evaluate the credit-rating of a customer. This agency would provide a rating for the customer as either a good risk or as a bad risk, this credit-rating being independent of the size of the loan being considered. Analysis of the last 1,000 customer ratings by this agency revealed the following information.

Determine the value of this credit rating to Venus.

(c) The Venus management believe that this first agency is not very good at selecting full-payers and non-payers. It considers contacting a second agency which guarantees perfect information concerning the credit rating of the customers.

Explain the meaning of the term 'perfect information' in the context of this question.

Calculate the value of this perfect information.

Step by Step Answer: