Ticklite Technologies is a large multinational conglomerate. The company manufactures and sells computers and computer-related gadgets, such

Question:

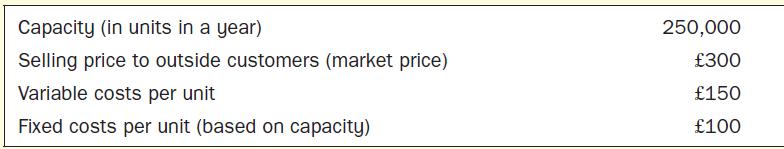

Ticklite Technologies is a large multinational conglomerate. The company manufactures and sells computers and computer-related gadgets, such as desktops, laptops, gaming consoles, graphics cards and computer software. The company has three separate businesses - the computer division, the graphics division and the software division. Each business is a subsidiary of Ticklite Technologies, is unrelated and acts independently. A year ago, the computer division of the company designed laptops with integrated gaming and graphics consoles. The laptops have been designed in such a way that the games and the graphics are enabled only when a 28GB graphics card is inserted in the laptop. The computer division of Ticklite Technologies has been purchasing the 28GB graphics card from Insta Gaming Solutions Ltd at a price of £295 per graphics card. The computer division of Ticklite Technologies has the capacity to produce 150,000 gaming laptops in a year. Hence, the computer division purchases 150,000 graphic cards in a year. The selling price of each laptop is £1,000. The gaming laptops manufactured and sold by Ticklite Technologies have been profitable to the company from the beginning. However, during the past three months the company has been facing a lot of competition. The company is planning to reduce the selling price of each gaming laptop to tackle the competition. Senior management of Ticklite Technologies has suggested that the computer division should purchase the graphics card from the graphics division of the company. Senior management feels that this intra-company transfer would help the computer division reduce the cost incurred in buying the graphics card. This will in turn reduce the selling price per laptop. Senior management is also under the impression that this transfer will help in increasing the profits of the subsidiaries as well as the parent company. The graphics division specializes in manufacturing and selling 6GB, 8GB, 24GB, 28GB and 48GB graphics cards. The details relating to the 28GB card manufactured and sold by the graphics division of Ticklite Technologies are given below:

Required

1. The managers of the computer division and the graphics division have agreed to set the transfer price at £250. Assume that the graphics division has sufficient idle capacity to fulfil the computer division’s requirement, and then:

(a) Determine the total contribution margin earned by the graphics division from the internal transfer.

(b) Determine the annual cost savings for the computer division if it purchases the graphics card from the graphics division of Ticklite Technologies rather than purchasing it from Insta Gaming Solutions Ltd.

2. Suppose Ticklite Technologies has a policy that allows only the selling division to set the transfer price. However, the buying division has the option to reject the proposal if the transfer price quoted is not within its budget. The managers of the graphics division want to earn a certain percentage of revenue while transferring its product internally. So, they have set the transfer price equivalent to the division’s variable cost plus a contribution margin of 140% of fixed costs per unit. Calculate the transfer price that the graphics division will want to charge the computer division.

3. Suppose Ticklite Technologies has a policy that allows only the selling division to set the transfer price and that the buying division cannot buy from other sources. The managers of the graphics division want the transfer price to be its market price.

(a) Determine the total contribution margin earned by the graphics division from the internal transfer.

(b) Determine the increase or decrease in the cost for the computer division if it purchases the graphics card from the graphics division of Ticklite Technologies rather than purchasing it from Insta Gaming Solutions Ltd.

Step by Step Answer:

Management Accounting

ISBN: 9780077185534

6th Edition

Authors: Will Seal, Carsten Rohde, Ray Garrison, Eric Noreen