Tracy Beckham began dabbling in pottery several years ago as a hobby. Her work is quite creative,

Question:

Tracy Beckham began dabbling in pottery several years ago as a hobby. Her work is quite creative, and it has been so popular with friends and others that she has decided to quit her job with an aerospace firm and manufacture pottery full time. The salary from Tracy's aerospace job is £2,500 per month. Tracy will rent a small building near her home to use as a place for manufacturing the pottery. The rent will be £500 per month. She estimates that the cost of clay and glaze will be £2 for each finished piece of pottery. She will hire workers to produce the pottery at a labour rate of £8 per pot. To sell her pots, Tracy feels that she must advertise heavily in the local area. An advertising agency states that it will handle all advertising for a fee of £600 per month. Tracy's brother will sell the pots; he will be paid a commission of £4 for each pot sold. Equipment needed to manufacture the pots will be rented at a cost of £300 per month. Tracy has already paid some start-up fees associated with her business. These fees amounted to £500. A small room has been located in a tourist area that Tracy will use as a sales office. The rent will be £250 per month. A phone installed in the room for taking orders will cost £40 per month. In addition, a recording device will be attached to the phone for taking after-hours messages. Tracy has some money in savings that is earning interest of £1,200 per year. These savings will be withdrawn and used to get the business going. For the time being, Tracy does not intend to draw any salary from the new company.

Required

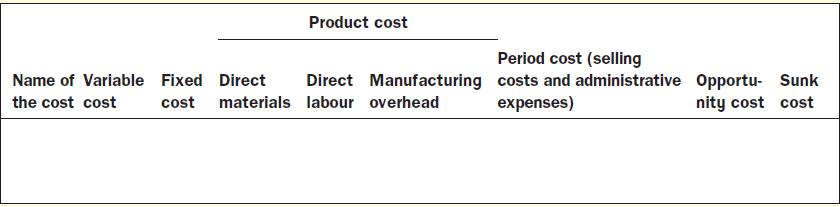

1. Prepare an answer sheet with the following column headings:

List the different costs associated with the new company down the extreme left column (under Name of cost). Then place an X under each heading that helps to describe the type of cost involved. There may be Xs under several column headings for a single cost. (That is, a cost may be a fixed cost, a period cost, and a sunk cost; you would place an X under each of these column headings opposite the cost.) Under the Variable cost column, list only those costs that would be variable with respect to the number of units of pottery that are produced and sold.

2. All the costs you have listed above, except one, would be differential costs between the alternatives of

Tracy producing pottery or staying with the aerospace firm. Which cost is not differential? Explain.

Step by Step Answer:

Management Accounting

ISBN: 9780077185534

6th Edition

Authors: Will Seal, Carsten Rohde, Ray Garrison, Eric Noreen