Tube and Pipe Ltd. (T&P) was founded in the early 1970s and its sales grew very rapidly

Question:

Tube and Pipe Ltd. (T&P) was founded in the early 1970s and its sales grew very rapidly until the beginning of the 1980s. At that time, several competitors expanded their operations and sales by T&P stabilized.

T&P uses substantial amounts of electricity in its manufacturing process. Therefore, the company had built a power plant that supplies all its electricity needs.

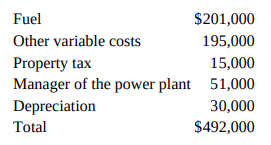

Annual consumption of electricity over the last two years has reached 9,300,000 kilowatt-hours (kWh). The annual production cost of electricity was $492,000, as follows:

In June 2010, Regional Hydro Ltd. approached T&P with an offer to supply all of its electricity needs. Regional Hydro will guarantee the supply for the next 20 years, but each party has the option of cancelling the agreement after 10 years.

If T&P signs the contract, it can sell its own power plant for $180,000. The book value of the plant is currently $300,000. In June 2010, the remaining life of the generators in the plant is 20 years. At the end of the 10th year, the generators must be given a major overhaul that would cost $450,000.

According to the proposed agreement, Regional Hydro will transfer the necessary power from its main plant to a secondary station that T&P will build. The secondary station will cost $1,200,000, its estimated life is 20 years, and it will have no salvage value. The firm will receive a 5 percent rebate on the cost of the secondary station from the government. The secondary station will convert the electricity from alternating current into direct current that T&P requires. The cost of electricity will be 1.5 cents per kWh and T&P is required to purchase at least 8,000,000 kWh annually. The maximum amount of electricity it can purchase is 10,000,000 kWh per year. T&P will pay the secondary station operation expenses (excluding depreciation) of $30,000 annually. Management of T&P decided that if it sells its power plant, the manager would be transferred to another department in need of a manager. It estimated that a new manager for the department would cost the company $45,000 a year, but the salary of the manager of the power plant will not change if he is transferred to the other department. Other employees of the power plant will be dismissed (their salaries are included in the “other variable costs” figure above).

Required

For simplification, assume that the CCA rate is 6 percent (Class 2), and all capital assets are in the same class for income tax purposes. Also assume that the corporate tax rate is 40 percent. Assume that the after-tax cost of capital is 12 percent. Prepare a report to the management of T&P advising them whether they should enter into the agreement with Regional Hydro.

Salvage ValueSalvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important... Cost Of Capital

Cost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of...

Step by Step Answer:

Management Accounting

ISBN: 978-0132570848

6th Canadian edition

Authors: Charles T. Horngren, Gary L. Sundem, William O. Stratton, Phillip Beaulieu