Tweedle Ltd has two divisions, Division Dee and Division Dum. Tweedle founded Dee on 1 January 2013.

Question:

Tweedle Ltd has two divisions, Division Dee and Division Dum. Tweedle founded Dee on 1 January 2013. Dum was an independent business that had been formed some years before. Tweedle purchased Dum as a going concern in August 2013. Tweedle's directors are keen to benchmark the two divisions, because they produce similar products.

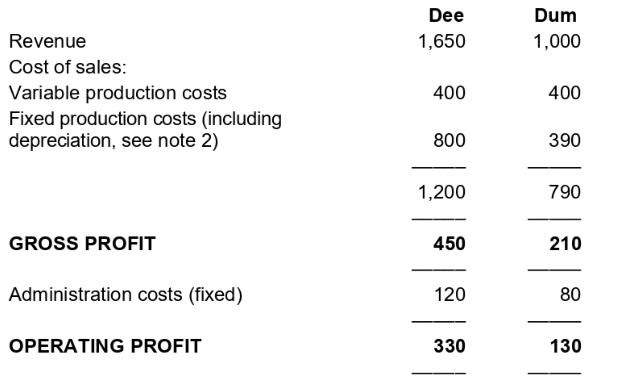

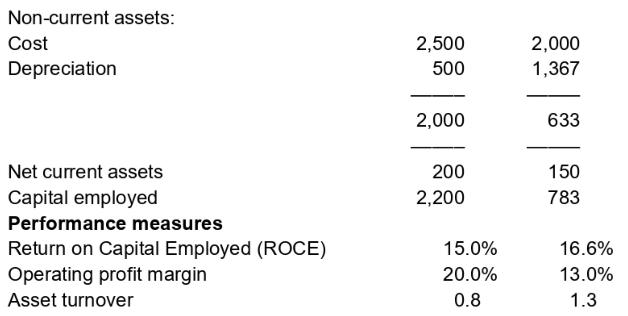

Details for the two companies for the year ended 31 December 2013 are as follows (in $\$ 000$ ):

1 Dee and Dum use different depreciation policies. Dee depreciates its non-current assets using straight-line depreciation, at the rate of $20 \%$ of cost with no residual value. Dum uses the reducing balance method of depreciation at the rate of $25 \%$ per annum.

2 Included in the fixed element of cost of sales for the year ended 31 December 2013 is depreciation of $\$ 500,000$ for Dee and $\$ 200,000$ for Dum.

3 Dee's assets are newer.

Tweedle's management team in charge of Dee have argued that it is unfair to compare them with Dum, because the two entities have different depreciation policies and Dee's assets are newer.

The parent company directors have agreed to restate Dee's results so that the assets are assumed to be the same age as Dum's, and the depreciation policy is the same.

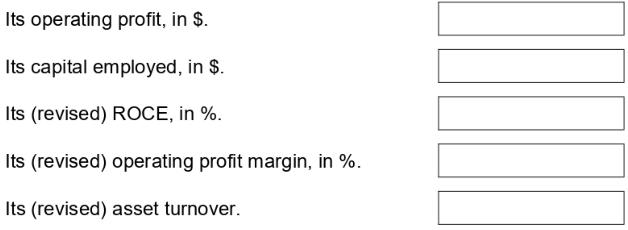

After aligning Dee's operating profits and capital employed, as well as its performance measures, restate, for Dee:

Step by Step Answer: