Wemake Machinery Ltd is evaluating the profitability of buying one of three machines. The machinery industry is

Question:

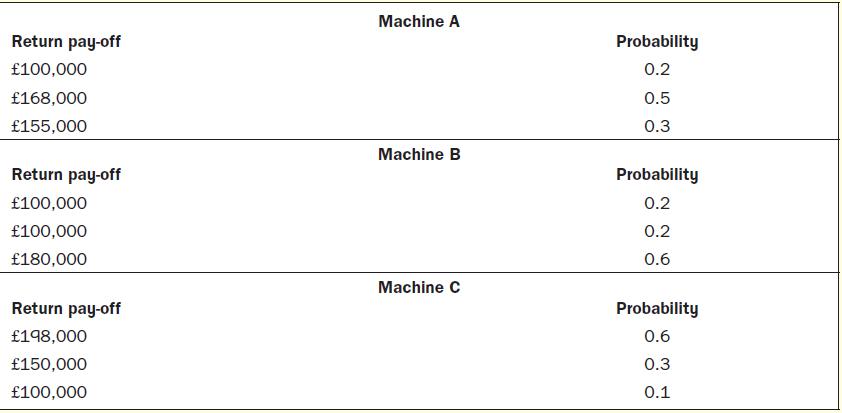

Wemake Machinery Ltd is evaluating the profitability of buying one of three machines. The machinery industry is currently unstable, and there is stiff competition within the industry. One poor decision can lead to massive revenue losses and loss of clients to competitors. All three machines meet the requirements of the company. However, to deal with the instability in the market, the machines need to be effective and efficient in terms of production time and quality. The company has employed an estimation engineer to assess the return pay-off from each of the three machines. The following are the return pay-offs from Machine A, Machine B and Machine C:

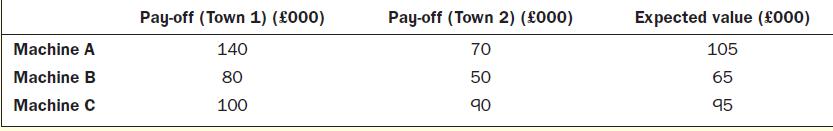

The company is further evaluating the probable benefit it could derive by deploying one of the three machines in either Town 1 or Town 2. The following is the expected value and estimated profit from Town 1 and Town 2:

With stiff competition prevailing in the industry, the company has entrusted the engineer to determine and

analyse any extra information that could help in decision making.

Required

1. Determine which machine should be selected if the estimation engineer wants to achieve a pay-off of £150,000 or greater.

2. Determine which machine should be selected if the estimation engineer wants to minimize the probability of having a negative pay-off. Also, determine the probability of getting a negative pay-off from Machine A, Machine B and Machine C.

3. Based on the expected value from Town 1 and Town 2, determine the value of extra information when the probability of each state is 0.5.

4. Wemake Machinery Ltd has considered the value of the extra information analysed by the engineer in determining the machine to be selected. Determine how the extra information has added value to its decision-making process.

Step by Step Answer:

Management Accounting

ISBN: 9780077185534

6th Edition

Authors: Will Seal, Carsten Rohde, Ray Garrison, Eric Noreen