Central Ltd has developed a new product, and is currently considering the marketing and pricing policy it

Question:

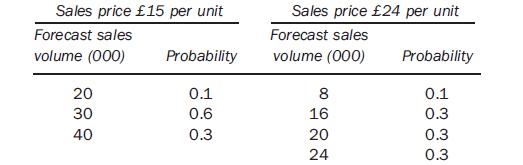

Central Ltd has developed a new product, and is currently considering the marketing and pricing policy it should employ for this. Specifically, it is considering whether the sales price should be set at £15 per unit or at the higher level of £24 per unit. Sales volumes at these two prices are shown in the following table:

The fixed production costs of the venture will be £38 000.

The level of the advertising and publicity costs will depend on the sales price and the market aimed for. With a sales price of £15 per unit, the advertising and publicity costs will amount to £12 000. With a sales price of £24 per unit, these costs will total £122 000.

Labour and variable overhead costs will amount to £5 per unit produced. Each unit produced requires 2 kg of raw material and the basic cost is expected to be £4 per kg. However, the suppliers of the raw materials are prepared to lower the price in return for a firm agreement to purchase a guaranteed minimum quantity. If Central Ltd contracts to purchase at least 40 000 kg then the price will be reduced to £3.75 per kg for all purchases. If Central contracts to purchase a minimum of 60 000 kg then the price will be reduced to £3.50 per kg for all purchases. It is only if Central Ltd guarantees either of the above minimum levels of purchases in advance that the appropriate reduced prices will be operative.

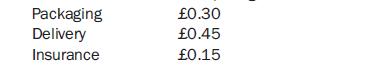

If Central Ltd were to enter into one of the agreements for the supply of raw material and was to find that it did not require to utilize the entire quantity of materials purchased then the excess could be sold. The sales price will depend upon the quantity that is offered for sale. If 16 000 kg or more are sold, the sales price will be £2.90 per kg for all sales. If less than 16 000 kg are offered, the sales price will be only £2.40 per kg.

Irrespective of amount sold, the costs incurred in selling the excess raw materials will be, per kg, as follows:

Central’s management team feels that losses are undesirable, while high expected money values are desirable. Therefore it is considering the utilization of a formula that incorporated both aspects of the outcome to measure the desirability of each strategy.

The formula to be used to measure the desirability is:

![]()

where L is the lowest outcome of the strategy and E is the expected monetary value of the strategy. The higher this measures, the more desirable the strategy.

The marketing manager seeks the advice of you, the management accountant, to assist in deciding the appropriate strategy. He says ‘we need to make two decisions now:

(i) Which price per unit should be charged: £15 or £24?

(ii) Should all purchases of raw materials be at the price of £4 per kg, or should we enter into an agreement for a basic minimum quantity? If we enter into an agreement then what minimum level of purchases should we guarantee?

As you are the management accountant, I expect you to provide me with some useful relevant figures.’

Required:

(a) Provide statements that show the various expected outcomes of each of the choices open to Central Ltd.

(b) Advise on its best choice of strategies if Central Ltd’s objective is:

(i) to maximize the expected monetary value of the outcomes;

(ii) to minimize the harm done to the firm if the worst outcome of each choice were to eventuate;

(iii) to maximize the score on the above mentioned measure of desirability.

(c) Briefly comment on either:

(i) two other factors that may be relevant in reaching a decision;

OR (ii) the decision criteria utilized in (b) above.

Step by Step Answer: