X Plc manufactures specialist insulating products that are used in both residential and commercial buildings. One of

Question:

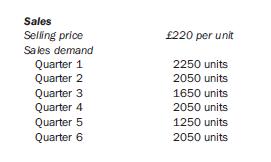

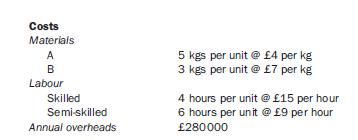

X Plc manufactures specialist insulating products that are used in both residential and commercial buildings. One of the products, Product W, is made using two different raw materials and two types of labour. The company operates a standard absorption costing system and is now preparing its budgets for the next four quarters. The following information has been identified for Product W:

40 per cent of these overheads are fixed and the remainder varies with total labour hours. Fixed overheads are absorbed on a unit basis.

The management team are concerned that X Plc has recently faced increasing competition in the market place for Product W. As a consequence there have been issues concerning the availability and costs of the specialized materials and employees needed to manufacture Product W, and there is concern that these might cause problems in the current budget setting process.

(a) Prepare the following budgets for each quarter for X Plc:

(i) Production budget in units;

(ii) Raw material purchases budget in kgs and value for Material B.

(b) X Plc has just been informed that Material A may be in short supply during the year for which it is preparing budgets.

Discuss the impact this will have on budget preparation and other areas of X Plc.

(c) Assuming that the budgeted production of Product W was 7700 units and that the following actual results were incurred for labour and overheads in the year:

Actual production 7250 units Actual overheads Variable £185 000 Fixed £105 000 Actual labour costs Skilled – £16.25 per hour £568 750 Semi-skilled – £8 per hour £332 400 Prepare a flexible budget statement for X Plc showing the total variances that have occurred for the above four costs only.

(d) X Plc currently uses incremental budgeting. Explain how zero based budgeting could overcome the problems that might be faced as a result of the continued use of the current system.

(e) Explain how rolling budgets are used and why they would be suitable for X Plc.

Step by Step Answer: