AA and BB are two divisions of the ZZ Group. The AA division manufactures electrical components, which

Question:

AA and BB are two divisions of the ZZ Group. The AA division manufactures electrical components, which it sells to other divisions and external customers.

The BB division has designed a new product, Product B, and has asked AA to supply the electrical component, Component A, that is needed in the new product. This will be a completely new style of component. Each unit of Product B will require one Component A. This component will not be sold by AA to external customers. AA has quoted a transfer price to BB of £45 for each unit of Component A.

It is the policy of the ZZ Group to reward managers based on their individual division’s return on capital employed.

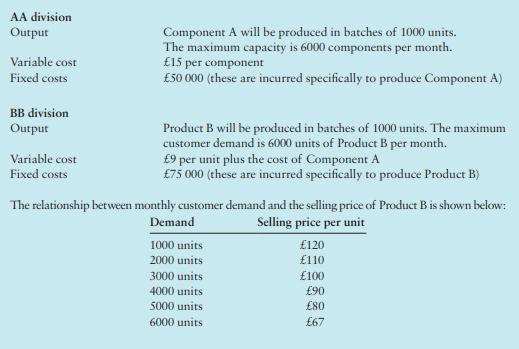

Details of the monthly production for each division are as follows:

Required

1. Calculate, based on a transfer price of £45 per Component A, the monthly profit that would be earned as a result of selling Product B by:

a. BB division

b. AA division

c. ZZ Group.

2. Calculate the maximum monthly profit from the sale of Product B for the ZZ Group.

3. Calculate, using the marginal cost of Component A as the transfer price, the monthly profit that would be earned as a result of selling Product B by: a BB division b AA division c ZZ Group.

4. Discuss, using the above scenario, the problems of setting a transfer price and suggest a transfer-pricing policy that would help the ZZ Group to overcome the transfer-pricing problems that it faces.

Step by Step Answer:

Management And Cost Accounting

ISBN: 9781292232669

7th Edition

Authors: Alnoor Bhimani, Srikant M. Datar, Charles T. Horngren, Madhav V. Rajan