Playtime, Inc. is a nationwide manufacturer of leisure products. In September of 20X2, the manager of the

Question:

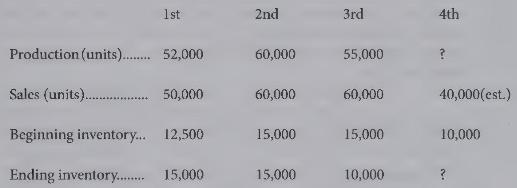

Playtime, Inc. is a nationwide manufacturer of leisure products. In September of 20X2, the manager of the Men's Swimwear Division is considering the division's production schedule for the fourth quarter. The manager is being considered for a promotion to corporate headquarters, and would like to show a healthy profit for the year in the division. However, a substantial federal income tax cut will occur in \(20 \times 3\), and a prudent policy would be to defer as much income as possible into that year. The following data is provided for each quarter in \(20 \times 2\) :

The standard variable cost is \(\$ 1.50\) per unit. Fixed factory overhead, budgeted at \(\$ 220,000\) per year, is allocated to units based on a normal activity of 55,000 units per quarter. Fixed selling and administrative expenses are budgeted at \(\$ 60,000\) per year. In the past, the division has followed the policy of setting production levels so that the inventory at the beginning of a quarter is equal to \(1 / 4\) of the quarter's sales. Practical capacity is 75,000 units; to maintain a stable work force production is never set at less than 30,000 units in a quarter. Projected sales for the first quarter of \(20 \mathrm{X} 3\) are 50,000 units. No materials, labor or variable overhead variances from standard are expected for the year. The selling price is \(\$ 3.00\) per unit, and absorption costing methods are used.

{Required:}

(a) If the previous inventory policy is followed, what production level would be set for the fourth quarter? What would be the resulting net income for 20X2?

(b) What production level for the fourth quarter would maximize net income? What would net income for the year be?

(c) What production level would defer income into the next year when tax rates will be lower? What would be the net income?

(d) For the three production levels above, determine the net income if variable costing methods were used.

Step by Step Answer:

Cost Accounting For Managerial Planning Decision Making And Control

ISBN: 9781516551705

6th Edition

Authors: Woody Liao, Andrew Schiff, Stacy Kline