The Keylo Co. manufactures a line of plastic products that are sold through hardware stores. The company

Question:

The Keylo Co. manufactures a line of plastic products that are sold through hardware stores. The company sales have declined slightly for the past two years leaving them with idle plants and equipment.

A Keylo engineer met a former college classmate while attending a recent convention of machinery builders. The classmate is employed by the Paddington Co. which is also in the plastic products business. During the course of their conversation it became evident that Keylo might be able to make a particular product for Paddington with the currently unused equipment and space. The following requirements were specified by Paddington for the new product:

1. Paddington needs 80,000 units per year for the next three years.

2. The product is to be built to Paddington specifications.

3. Keylo is not to enter into the independent production of the product during the three year contract.

4. Paddington would provide Keylo, without charge, a special machine to finish the product. The machine becomes the property of the Keylo at the end of the three year period.

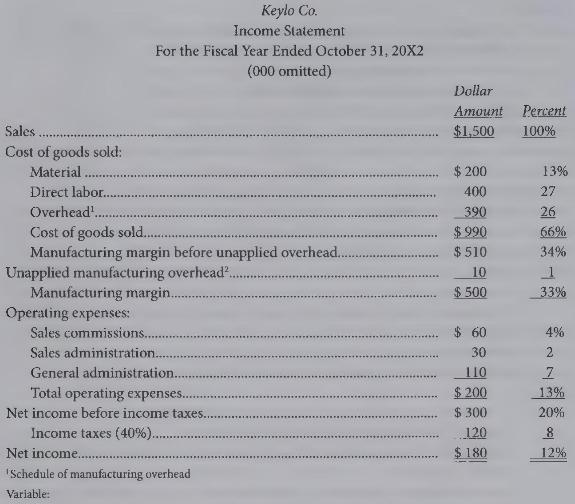

Although Keylo is not operating at capacity, the company generated a profit last year as is shown in the income statement presented as follows:

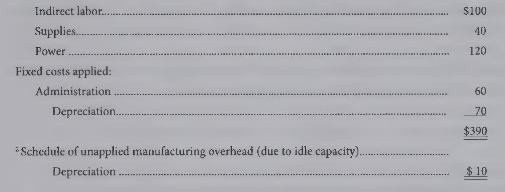

The Keylo engineering, production, and accounting departments agreed upon the following facts if the contracts were accepted.

1. Manufacturing}

a. The present idle capacity would be fully used.

b. One additional supervisor would be required; the annual salary would be \(\$ 15,000\) at the present rates.

c. The annual requirements for material and labor would increase by \(10 \%\) at current prices.

d. The power and supply requirements would increase \(10 \%\) at current prices due to the reactivation of idle machines.

e. The machine provided by Paddington would increase the annual power and supply costs by \(\$ 10,000\) and \(\$ 4,000\), respectively, at current prices.

f. The Paddington machine would have no value to Keylo at the end of the contract.

2. Sales:

a. A sales commission of \(\$ 10,000\) would be paid to the sales persons arranging the contract.

b. No additional sales administrative costs would be incurred.

3. General administration: No additional general administrative costs would be incurred.

4. Other information

a. Estimated cost increases due to inflation for the entire three year period are shown

{Required:}

(a) Calculate the total price needed for the three year order (240,000 units) if the company wants to make \(10 \%\) after taxes on the sales price of this order.

(b) Calculate the total price for the three year order ( 240,000 units) if this order were to contribute nothing to net income after taxes.

(c) Would the answer you calculated in

(b) above contribute to existing fixed costs? Explain your answer.

Step by Step Answer:

Cost Accounting For Managerial Planning Decision Making And Control

ISBN: 9781516551705

6th Edition

Authors: Woody Liao, Andrew Schiff, Stacy Kline