The Patton Corporation has gone through a period of rapid expansion to reach its present size of

Question:

The Patton Corporation has gone through a period of rapid expansion to reach its present size of seven divisions. The expansion program has placed strains on its cash resources. Therefore, the need for better cash planning at the corporate level has become very important.

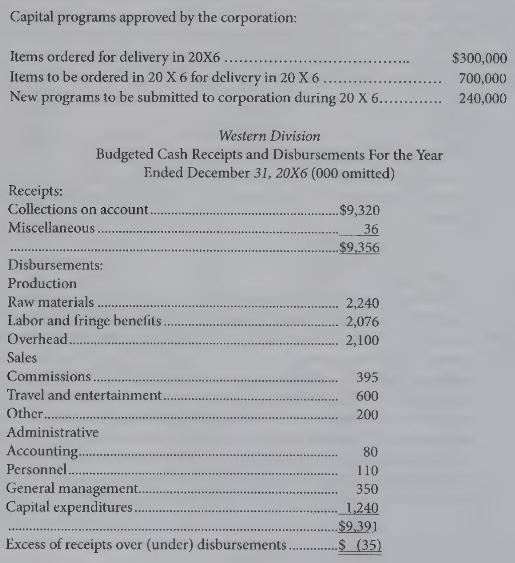

At the present time each division is responsible for the collection of receivables and the disbursements for all operating expenses and approved capital projects. The corporation does exercise control over division activities and has attempted to coordinate the cash needs of the divisions and the corporation. However, it has not yet developed effective division cash reports from which it can determine the needs and availability of cash in the next budgetary year. As a result of inadequate information, the corporation permitted some divisions to make expenditures for goods and services which need not have been made or which could have been postponed until a later time while other divisions had to delay expenditures which should have had a greater priority. The 20X6 cash receipts and disbursements plan prepared by the Western Division for submission to the corporate office is presented below. The following additional information was used by the Western Division to develop the cash receipts and disbursements budget.

1. Receipts-Miscellaneous receipts are estimated proceeds from the sales of unneeded equipment.

2. Sales-Travel and entertainment represents the costs required to produce the sales volume projected for the year. The other sales costs consist of \(\$ 50,000\) for training new sales personnel, \(\$ 25,000\) for attendance by sales personnel at association meetings (not sales shows), and \(\$ 125,000\) for sales management salaries.

3. Administration-The personnel costs include \(\$ 50,000\) for salary and department operating costs, \(\$ 20,000\) for training new personnel and \(\$ 40,000\) for management training courses for current employees. The general management costs include salaries and office costs for the division management, \(\$ 310,000\), plus \(\$ 10,000\) for officials' travel to Patton Corporation meetings and \(\$ 30,000\) for industry and association conferences.

4. Capital expenditures-Planned expenditures for capital items during 20X6 are as follows:

Required:

Present a revised budgeted cash receipts and disbursement statement for the Western Division. Design the format of the revised statement to include adequate detail so as to improve the ability of the corporation to judge the urgency of the cash needs. Such a statement would be submitted by all divisions to provide the basis for overall corporation cash planning.

Step by Step Answer:

Cost Accounting For Managerial Planning Decision Making And Control

ISBN: 9781516551705

6th Edition

Authors: Woody Liao, Andrew Schiff, Stacy Kline