Alpha Division, which is part of the Delta Group, is considering an investment opportunity to which the

Question:

Alpha Division, which is part of the Delta Group, is considering an investment opportunity to which the following estimated information relates:

1. An initial investment of $45m in equipment at the beginning of year 1 will be depreciated on a straight line basis over a three-year period with a nil residual value at the end of year 3.

2. Net operating cash inflows in each of years 1 to 3 will be $12.5m, $18.5m and $27m respectively.

3. The management accountant of Alpha Division has estimated that the NPV of the investment would be $1.937m using a cost of capital of 10 percent.

4. A bonus scheme that is based on short-term performance evaluation is in operation in all divisions within the Delta Group.

Required:

(a) (i) Calculate the residual income of the proposed investment and comment briefly (using ONLY the above information) on the values obtained in reconciling the short-term and long-term decision views likely to be adopted by divisional management regarding the viability of the proposed investment.(ii) A possible analysis of divisional profit measurement at Alpha Division might be as follows:

...................................................................................$m

Sales revenue .........................................................xxx

Less: variable costs ................................................xxx

1. Variable short run contribution margin ..........xxx

Less: controllable fixed costs ................................xxx

2. Controllable profit ..............................................xxx

Less: non-controllable avoidable costs ................xxx

3. Divisional profit ...................................................xxx

Discuss the relevance of each of the divisional profit measures 1, 2 and 3 in the above analysis as an acceptable measure of divisional management performance and/or divisional economic performance at Alpha Division.

You should use appropriate items from the following list relating to Alpha Division in order to illustrate your discussion:

(i) Sales to customers external to the Delta Group.

(ii) Inter-divisional transfers to other divisions within the Delta Group at adjusted market price.

(iii) Labour costs or equipment rental costs that are fixed in the short term.(iv) Depreciation of non-current assets at Alpha Division.(v) Head office finance and legal staff costs for services provided to Alpha Division.

(b) Summary financial information for the Gamma Group (which is not connected with the Delta Group) is as follows:

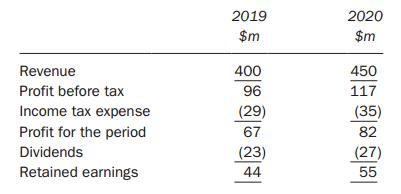

Income statements/financial information:

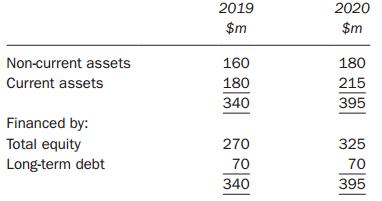

Balance sheets:

Other information is as follows:

1. Capital employed at the end of 2018 amounted to $279m.

2. The Gamma Group had non-capitalized leases valued at $16m in each of the years 2018 to 2020 which were not subject to amortization.

3. Amortization of goodwill amounted to $5m per year in both 2019 and 2020. The amount of goodwill written off against reserves on acquisitions in years prior to 2019 amounted to $45m.

4. The Group's pre-tax cost of debt was estimated to be 10 percent.

5. The Group's cost of equity was estimated to be 16 percent in 2019 and 18 percent in 2020.

6. The target capital structure is 50 percent equity, 50 percent debt.

7. The rate of taxation is 30 percent in both 2019 and 2020.

8. Economic depreciation amounted to $40m in 2019 and $45m in 2020. These amounts were equal to the depreciation used for tax purposes and depreciation charged in the income statements.

9. Interest payable amounted to $6m per year in both 2019 and 2020.

10. Other non-cash expenses amounted to $12m per year in both 2019 and 2020.

(i) Stating clearly any assumptions that you make, estimate the economic value added (EVATM?) of the Gamma Group for both 2019 and 2020 and comment briefly on the performance of the Group.

(ii) Briefly discuss THREE disadvantages of using EVATM? in the measurement of financial performance.

Contribution MarginContribution margin is an important element of cost volume profit analysis that managers carry out to assess the maximum number of units that are required to be at the breakeven point. Contribution margin is the profit before fixed cost and taxes... Goodwill

Goodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of... Capital Structure

Capital structure refers to a company’s outstanding debt and equity. The capital structure is the particular combination of debt and equity used by a finance its overall operations and growth. Capital structure maximizes the market value of a... Cost Of Capital

Cost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of... Cost Of Debt

The cost of debt is the effective interest rate a company pays on its debts. It’s the cost of debt, such as bonds and loans, among others. The cost of debt often refers to before-tax cost of debt, which is the company's cost of debt before taking... Cost Of Equity

The cost of equity is the return a company requires to decide if an investment meets capital return requirements. Firms often use it as a capital budgeting threshold for the required rate of return. A firm's cost of equity represents the...

Step by Step Answer: