Assume that you have been appointed finance director of Breckall plc. The company is considering investing in

Question:

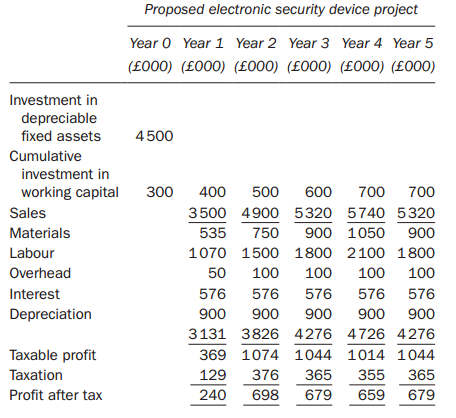

Assume that you have been appointed finance director of Breckall plc. The company is considering investing in the production of an electronic security device, with an expected market life of five years.The previous finance director has undertaken an analysis of the proposed project; the main features of his analysis are shown below. He has recommended that the project should not be undertaken because the estimated annual accounting rate of return is only 12.3 percent:

Total initial investment is ?4 800 000.Average annual after tax profit is ?591 000.All the above cash flow and profit estimates have been prepared in terms of present-day costs and prices, since the previous finance director assumed that the sales price could be increased to compensate for any increase in costs.You have available the following additional information:(a) Selling prices, working capital requirements and overhead expenses are expected to increase by 5 percent per year.

(b) Material costs and labour costs are expected to increase by 10 percent per year.(c) Capital allowances (tax depreciation) are allowable for taxation purposes against profits at 25 percent per year on a reducing balance basis.(d) Taxation on profits is at a rate of 35 percent, payable one year in arrears.(e) The fixed assets have no expected salvage value at the end of five years.(f) The company?s real after-tax weighted average cost of capital is estimated to be 8 percent per year, and nominal after-tax weighted average cost of capital 15 percent per year.Assume that all receipts and payments arise at the end of the year to which they relate, except those in year 0, which occur immediately.

Required:(a) Estimate the net present value of the proposed project. State clearly any assumptions that you make.(b) Calculate by how much the discount rate would have to change to result in a net present value of approximately zero.(c) Describe how sensitivity analysis might be used to assist in assessing this project. What are the weaknesses of sensitivity analysis in capital investment appraisal?Briefly outline alternative techniques of incorporating risk into capital investment appraisal.

Net Present ValueWhat is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at... Salvage Value

Salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important... Cost Of Capital

Cost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of... Discount Rate

Depending upon the context, the discount rate has two different definitions and usages. First, the discount rate refers to the interest rate charged to the commercial banks and other financial institutions for the loans they take from the Federal...

Step by Step Answer: