At the end of last year, a group of architects and engineers in Squamish, B.C., decided to

Question:

At the end of last year, a group of architects and engineers in Squamish, B.C., decided to join efforts in providing one-stop design and engineering consulting services to the construction industry. The founding partners decided to divide the operation into three parts: the Consulting Department,

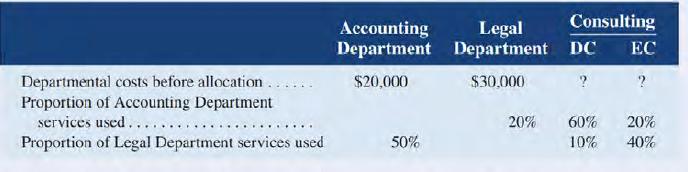

the Legal Department, and the Accounting Department. The consulting department deals directly with the clients, providing two somewhat distinct services, design consulting (DC) and engineering consulting (EC). In its first full month of operations, the consulting department incurred costs of $40,000, with 40% attributed to design consultations and 60% to engineering consultations. Billings to clients amounted to $80,000 and $5 1,000 for design and engineering consultations, respectively. This department made use of the other two departments' services in preparing work for the external clients. The accounting and legal departments also provided professional services for each other and for the two consulting departments on the basis of time according to the following schedule:

Having completed the first month's activity, the partners are ready to evaluate the performance of the group and of the individual areas.

Required:

Prepare an income statement for DC and EC using ;

(1) The direct allocation method.

(2) The stepdown method.

Recommend one of the two methods to the partners and justify your choice.

Step by Step Answer:

Managerial Accounting

ISBN: 9781260193275

12th Canadian Edition

Authors: Ray H. Garrison, Alan Webb, Theresa Libby