Courtney Limited has capital project opportunities each of which would require an initial investment of $400,000. Details

Question:

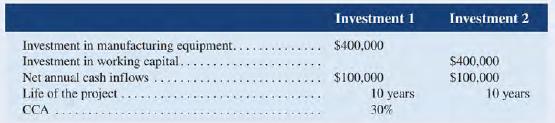

Courtney Limited has capital project opportunities each of which would require an initial investment of $400,000. Details for each opportunity are shown below:

The robotic equipment would have a salvage value of $75,000 in 12 years. The equipment would be depreciated over 12 years. At the end of 12 years, the investment in working capital would be released for use elsewhere. The company requires an after-tax return of 12% on all investments. The tax rate is 30%.

Required:

Compute the net present value of each investment project.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Managerial Accounting

ISBN: 9781260193275

12th Canadian Edition

Authors: Ray H. Garrison, Alan Webb, Theresa Libby

Question Posted: