Markus Companys common stock sold for $2.75 per share at the end of this year. The company

Question:

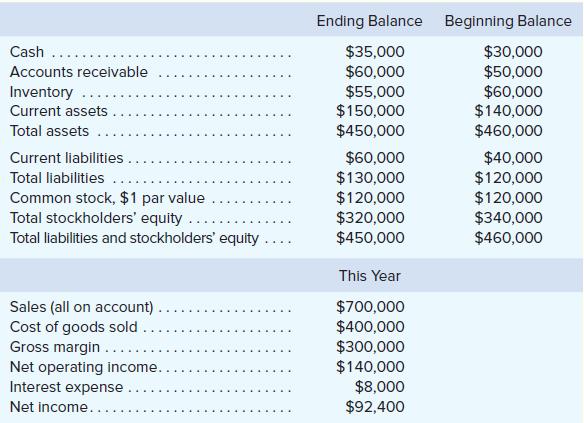

Markus Company’s common stock sold for $2.75 per share at the end of this year. The company paid a common stock dividend of $0.55 per share this year. It also provided the following data excerpts from this year’s financial statements:

Required:

1. What is the earnings per share?

2. What is the price-earnings ratio?

3. What is the dividend payout ratio and the dividend yield ratio?

4. What is the return on total assets (assuming a 30% tax rate)?

5. What is the return on equity?

6. What is the book value per share at the end of this year?

7. What is the amount of working capital and the current ratio at the end of this year?

8. What is the acid-test ratio at the end of this year?

9. What is the accounts receivable turnover and the average collection period?

10. What is the inventory turnover and the average sale period?

11. What is the company’s operating cycle?

12. What is the total asset turnover?

13. What is the times interest earned ratio?

14. What is the debt-to-equity ratio at the end of this year?

15. What is the equity multiplier?

Step by Step Answer:

Managerial Accounting

ISBN: 9781260247787

17th Edition

Authors: Ray Garrison, Eric Noreen, Peter Brewer