Refer to the data in Exercise 16-2 for Weller Corporation. Data From Exercise 16-2: Comparative financial statements

Question:

Refer to the data in Exercise 16-2 for Weller Corporation.

Data From Exercise 16-2:

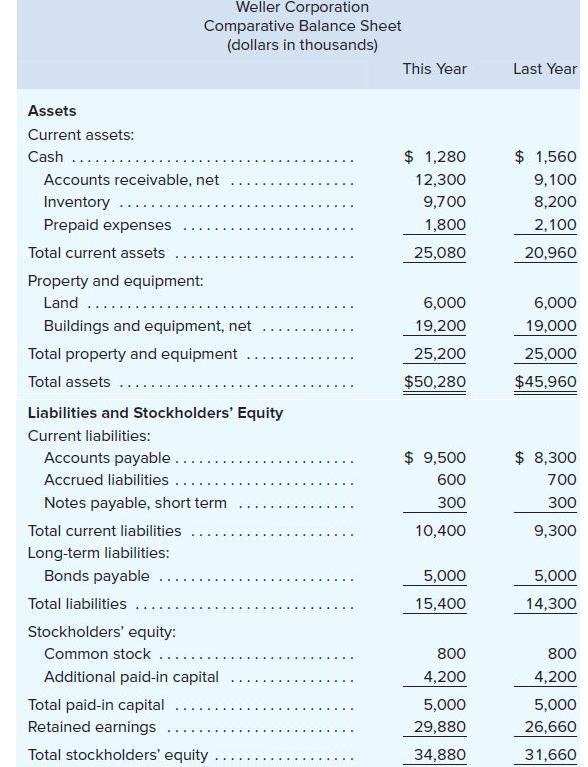

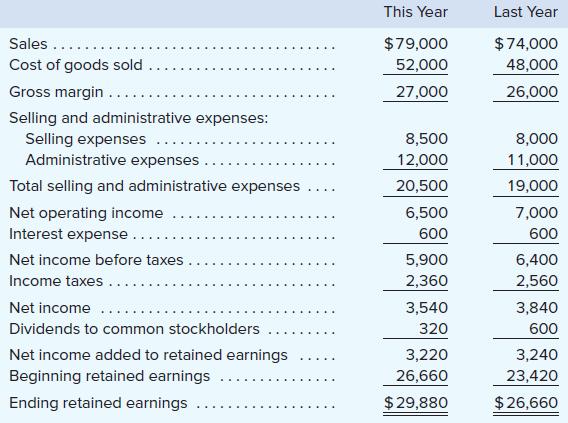

Comparative financial statements for Weller Corporation, a merchandising company, for the year ending December 31 appear below. The company did not issue any new common stock during the year. A total of 800,000 shares of common stock were outstanding. The interest rate on the bond payable was 12%, the income tax rate was 40%, and the dividend per share of common stock was $0.75 last year and $0.40 this year. The market value of the company’s common stock at the end of this year was $18. All of the company’s sales are on account.

Weller Corporation

Comparative Income Statement and Reconciliation

(dollars in thousands)

Required:

Compute the following financial data for this year:

1. Accounts receivable turnover. (Assume that all sales are on account.)

2. Average collection period.

3. Inventory turnover.

4. Average sale period.

5. Operating cycle.

6. Total asset turnover.

Step by Step Answer:

Managerial Accounting

ISBN: 9781260247787

17th Edition

Authors: Ray Garrison, Eric Noreen, Peter Brewer