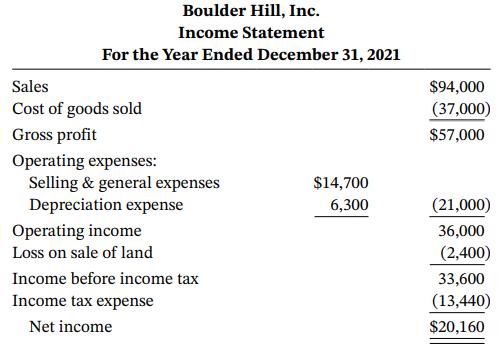

Below is an income statement for Boulder Hill for the year ended December 31, 2021 and the

Question:

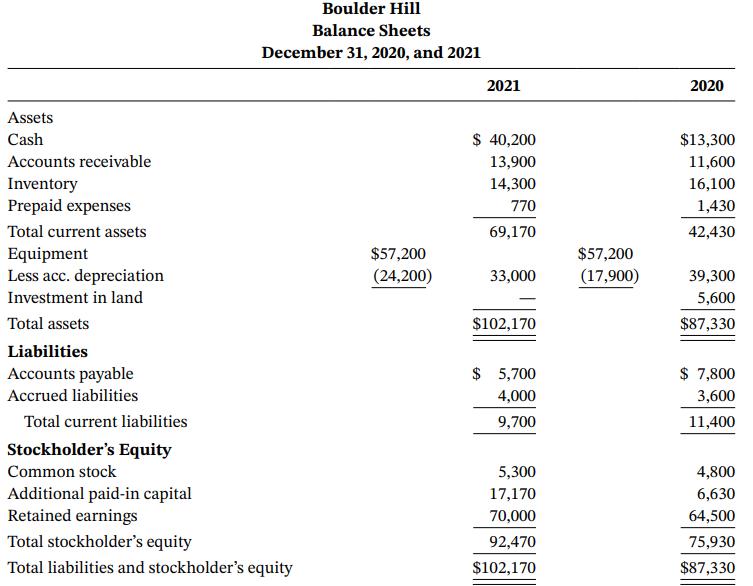

Below is an income statement for Boulder Hill for the year ended December 31, 2021 and the company’s balance sheets as of December 31, 2020, and 2021.

The prepaid expenses and accrued liabilities included in Boulder Hill’s balance sheets involve selling or general (operating) expenses. All of Boulder Hill’s sales and merchandise purchases are made on a credit basis.

Required

Determine the following amounts:

______ a.Cash spent on new equipment.

______ b.Net amount of investing cash flows.

______ c.Cash received from issuing stock.

______ d.Cash paid to suppliers of inventory.

______ e.Cash paid for selling and general expenses.

______ f. Cash received from the sale of land.

______ g.Cash received from the sale of equipment.

______ h.Cash received from customers.

______ i. Cash paid for dividends.

______ j. Net amount of operating cash flows.

______ k.Net amount of financing cash flows.

Step by Step Answer: