Chumpy Lighting Limited manufactures a wide variety of light bulbs which it sells to lighting shops and

Question:

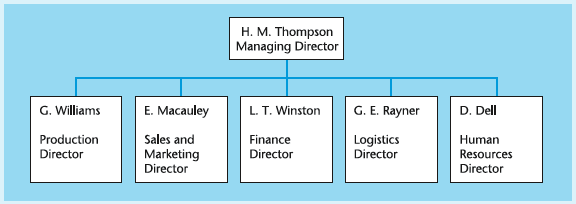

Organizational structure of Chumpy Lighting Limited

Summary of Eindnacht€™s report on Chumpy Lighting Limited

Products

Chumpy Lighting serves two distinct light bulb market segments, domestic and industrial. No new products have been launched in either sector in the last two years. Twelve years ago, in response to a growing market, the €˜Alpha€™ range of 20 different low-energy long-life domestic bulbs was introduced. A significant investment in new plant and machinery was made to produce this range. The traditional tungsten filament light bulbs were phased out over two years from the introduction of the Alpha range which now accounts for 100% of domestic bulb production. The €˜Beta€™ range of industrial bulbs was introduced five years ago in an attempt to achieve increased sales and profits. There are now 154 different bulbs in this range.

Production

On the basis of €˜number of bulbs produced€™, the Alpha and Beta ranges account for 73% and 27% of production respectively. Production facilities are used Mondays to Fridays from 08:00 to 17:00 with operatives allowed a morning and afternoon break of 15 minutes each and a one-hour lunch break. The factory is closed for five weeks each year during which holidays must be taken. The last new product, the €˜Everlasting Halogen Spotlight€™ (EHS) bulb, aimed at the industrial security sector, was launched by Chumpy Lighting just over two years ago. Unfortunately, due to a manufacturing fault, the EHS was prone to overheating and had a high failure rate. On several occasions, the EHS exploded causing potential physical danger to anyone in the vicinity at the time. Fortunately, only one serious injury occurred and a damaging legal case was only avoided by a significant out-of-court settlement being made to the injured person. Although much negative publicity was avoided, negative rumours concerning product safety circulated in the industry. A product recall had to be performed and the EHS production process had to be redesigned to correct the fault. This resulted in a five-month gap before the EHS was relaunched. It is estimated that this and the attendant bad publicity caused a 5% fall in annual sales revenue from the Beta range for that year in addition to the very significant cost of the recall operation.

Marketing and sales

It is estimated that the domestic bulb market is worth approximately three times as much as the industrial bulb market. Domestic: Apart from the last year, spending on advertising and promotion has shown very little variation in monetary terms (indicating a reduced spend in real terms). During this period, sales volumes have increased by an average of 2% a year. However, the market size of low-energy long-life domestic bulbs has increased by 8% a year on average over the same period. Selling price increases have generally matched inflation at around 2% a year except for an increase of 5% two years ago in an attempt to boost revenue. Superficial changes and new packaging were introduced at this point in an attempt to reposition the Alpha bulbs. Unfortunately, this strategy does not seem to have worked; the loss in volume caused by the price increase appears to have countered the extra revenue gained from higher prices in an increasingly competitive market. Industrial: During the first three years of its life, the Beta range of industrial bulbs approximately doubled its sales each year until the EHS recall. Due to an increased spend on advertising and promotion, sales have now recovered to the level immediately prior to this incident. For the last decade or so, this market sector has increased by about 3% a year.

Tasks:

1. Create a balanced scorecard for Chumpy Lighting Limited in the form of a diagram; show clearly your chosen perspectives, objectives, key performance indicators and target performance levels. Summary draft action plans should also be shown.

2. From your balanced scorecard, create a strategy map for Chumpy Lighting Ltd. Start by identifying the cause and effect relationships between the objectives.

Step by Step Answer:

Managerial Accounting Decision Making and Performance Management

ISBN: 978-0273764489

4th edition

Authors: Ray Proctor