Shoes Ltd has operated in the retail sector for the past eight years. A summary of its

Question:

Trading and profit and loss account

£000

Sales....................................................... 1,200

Cost of sales............................................. 740

Gross profit.............................................. 460

Expenses.................................................. 390

Interest....................................................... 12

Net profit.................................................... 58

Balance sheet

.................................................. £000 £000

Fixed assets (at WDV)........................................... 700

Current assets:

Stock.......................................... 240

Debtors...................................... 10

250

Less: Current liabilities:

Creditors...................................... 50

Taxation....................................... 14

Dividends.................................... 35

Bank overdraft........................... 14

....................................................113

Net current assets................... 137

Net total assets........................ 837

Debentures................................ 98

................................................... 739

Financed by:

Equity capital........................... 100

Reserves................................... 639

................................................... 739

Task:

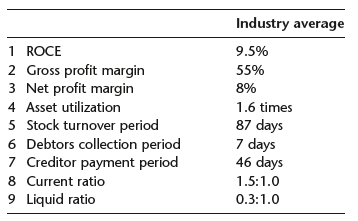

You are required to calculate the following ratios and, by comparing them with the industry averages shown below, comment upon the financial state of the company, particularly with regard to liquidity, profitability and working capital management. (Assume the opening stock for the year was £220,000 and that only 20% of sales are made on credit terms.)

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Managerial Accounting Decision Making and Performance Management

ISBN: 978-0273764489

4th edition

Authors: Ray Proctor