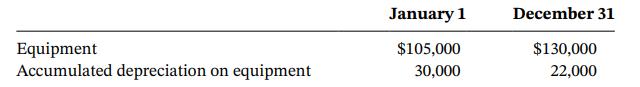

The Motta Storage Company had the following balances in its Equipment and Accumulated Depreciation on Equipment accounts

Question:

The Motta Storage Company had the following balances in its Equipment and Accumulated Depreciation on Equipment accounts at the beginning and end of 2021:

During 2021, Motta engaged in the following transaction involving equipment: Sold equipment that originally cost $25,000 and had a current book value of $9,000 for $18,500. This was the only sale of equipment.

Net income for 2021 was $380,000.

Required

a. How much equipment-related depreciation expense did the Motta Storage Company record during 2021?

b. What was the cost of equipment purchased during the year?

c. Using this limited information, prepare the operating and investing activities sections of the statement of cash flows. Here you will assume that there were no changes in current asset and current liability accounts other than cash.

Step by Step Answer: