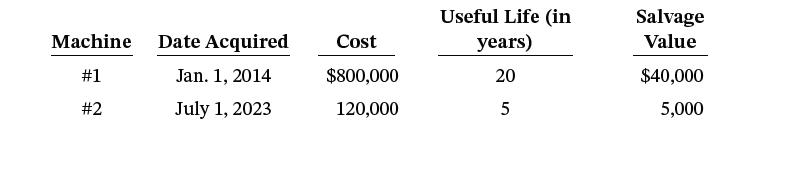

Kelly Machines reported the following information about two of its machines as of December 31, 2023. Instructions

Question:

Kelly Machines reported the following information about two of its machines as of December 31, 2023.

Instructionsa. Calculate the annual depreciation for each asset using the straight-line method.b. Calculate the accumulated depreciation and book value of each asset on December 31, 2024.c. If the company determined during 2025 that machine #2 now has a salvage value of $10,000, would you expect the accumulated depreciation as of December 31, 2024, to change? If so, would it likely increase or decrease?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Accounting Tools For Business Decision Making

ISBN: 9781119791058

8th Edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Jill E. Mitchell

Question Posted: