Each morning, Jamal Imery stocks the drink case at Jamals Beach Hut in Charlotte, North Carolina. Jamals

Question:

Each morning, Jamal Imery stocks the drink case at Jamal’s Beach Hut in Charlotte, North Carolina. Jamal’s Beach Hut has 110 linear feet of refrigerated display space for cold drinks. Each linear foot can hold either five 12-ounce cans or three 20-ounce plastic or glass bottles. The beverage stands sells three types of cold drinks:

1. Cola in 12-oz. cans for \($1.40\) per can 2. Bottled water in 20-oz. plastic bottles for \($1.75\) per bottle 3. Orange juice in 20-oz. glass bottles for \($2.10\) per bottle Jamal’s Beach Hut pays its suppliers the following:

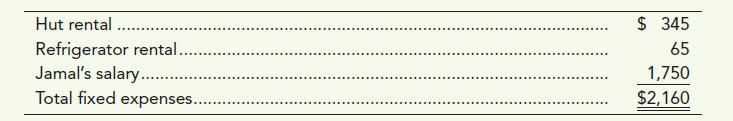

1. \($0.20\) per 12-oz. can of cola 2. \($0.45\) per 20-oz. bottle of water 3. \($0.75\) per 20-oz. bottle of orange juice Jamal’s Beach Hut’s monthly fixed expenses include the following:

The beverage stand can sell all drinks stocked in the display case each morning.

Requirements:

1. What is the constraining factor at Jamal’s Beach Hut? What should Jamal stock to maximize profits? What is the maximum contribution margin he could generate from refrigerated drinks each day?

2. To provide variety to customers, suppose Jamal refuses to devote more than 60 linear feet and no less than 20 linear feet to any individual product. Under this condition, how many linear feet of each drink should be stocked? How many units of each product will be available for sale each day?

3. Assuming the product mix calculated in Requirement 2, what contribution margin will be generated from refrigerated drinks each day?

Step by Step Answer: