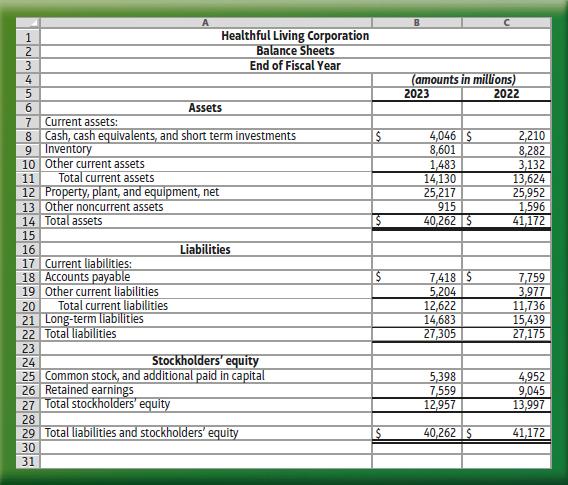

Healthful Living Corporations income statement was presented in Summary Problem 1. The companys balance sheets (adapted) at

Question:

Healthful Living Corporation’s income statement was presented in Summary Problem 1. The company’s balance sheets (adapted) at the end of fiscal years 2023 and 2022 are presented below.

Other company information follows:

• The company has few receivables since customers pay with cash, debit, or credit cards.

Healthful Living credit card operations were sold in 2021. Therefore, receivables are reported as part of other current assets.

• There were 627.7 million common shares issued and outstanding at the end of fiscal year 2023. Healthful Living had no preferred stock issued or outstanding.

• Cash dividends of \($2.20\) per share were declared during fiscal year 2023.

• The closing market price per share was \($72.42\) on January 30, 2024 (the end of fiscal year 2023).

Requirement:

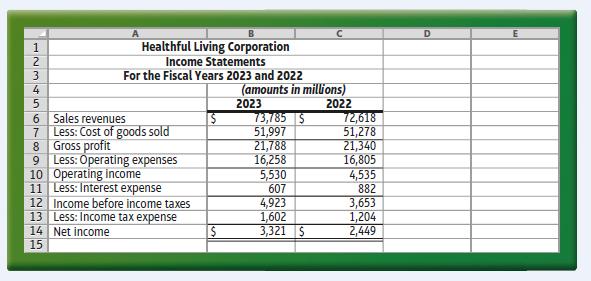

Calculate the following ratios for fiscal year 2023:

1. Current ratio

2. Acid-test ratio

3. Inventory turnover

4. Debt ratio

5. Times-interest-earned ratio

6. Rate of return on net sales

7. Rate of return on total assets

8. Rate of return on common stockholders’ equity

9. Earnings per share of common stock

10. Price/earnings ratio

11. Dividend yield

12. Book value per share of common stock

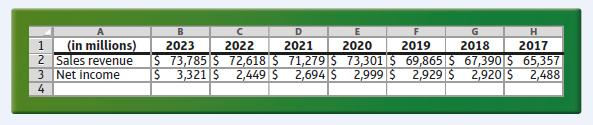

Data From Summary Problem 1:-

Healthful Living Corporation’s annual sales and net income data for the years 2017–2023 as well as the company’s 2023 and 2022 comparative income statements are presented below.

Step by Step Answer: